Non Profit Executive Retirement Plans: Secure Your Future Today

Are you leading a nonprofit and thinking about your retirement? Planning your financial future doesn’t have to be confusing or overwhelming.

Understanding the best retirement plans for nonprofit executives can help you secure the lifestyle you deserve after years of dedicated service. This article will guide you through the options designed specifically for people like you, so you can make smart choices with confidence.

Keep reading to discover how to protect your future and enjoy peace of mind.

Credit: astronsolutions.net

Retirement Plan Options

Nonprofit executives need retirement plans that fit their unique roles. These plans help save money for the future with tax benefits. Various options exist, each with its own features and rules. Choosing the right plan can secure a comfortable retirement.

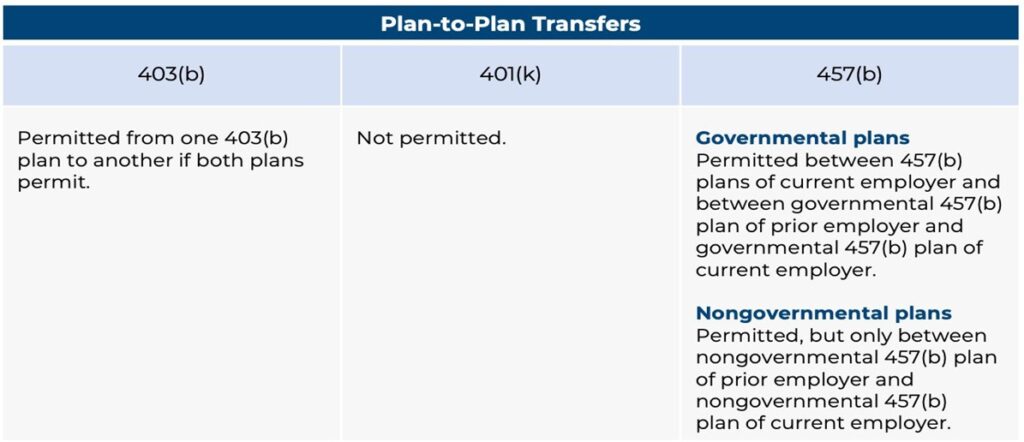

403(b) Plans

403(b) plans are common for nonprofit employees. They allow pre-tax contributions, lowering taxable income. Employers may also add matching funds to grow savings. The money grows tax-deferred until withdrawal. This plan suits executives wanting steady, long-term savings.

457(b) Plans

457(b) plans are available to some nonprofit leaders. They offer tax-deferred growth and no early withdrawal penalties before age 59½. Contributions reduce taxable income each year. These plans provide extra saving space beyond 403(b) limits. Good for those who want flexible access to funds.

Sep Iras

SEP IRAs work well for nonprofits with fewer employees. Employers contribute directly to the executive’s IRA. Contribution limits are high compared to other IRAs. Funds grow tax-deferred until retirement. This option is simple and flexible for nonprofit executives.

Credit: www.captrust.com

Benefits For Nonprofit Executives

Nonprofit executives have unique retirement needs. Their retirement plans offer distinct benefits tailored to their roles. These benefits help secure financial stability after years of service. Understanding these advantages can guide better planning for a comfortable future.

Tax Advantages

Nonprofit executive retirement plans often provide tax benefits. Contributions may be tax-deductible, lowering taxable income. Earnings on investments grow tax-deferred until withdrawal. This helps money grow faster over time. Tax savings add up and boost retirement funds.

Employer Contributions

Many nonprofits contribute to executives’ retirement plans. These contributions add to personal savings without extra cost. Employer contributions increase the total retirement balance significantly. It shows the organization’s commitment to its leaders. This boost helps build a stronger financial foundation.

Flexible Investment Choices

Executives can choose from various investment options. Flexibility allows matching investments with personal risk tolerance. Options may include stocks, bonds, and mutual funds. This variety helps balance growth and security. Smart choices lead to better retirement outcomes.

Plan Eligibility And Enrollment

Understanding plan eligibility and enrollment is key for non profit executives. It helps ensure smooth access to retirement benefits. Clear rules guide who can join and how to start. This section explains the main points about eligibility and enrollment.

Qualification Criteria

Non profit executives must meet specific rules to qualify. These often include age and length of service. Some plans require executives to work at least 1,000 hours yearly. Others may have a minimum time in the organization, like one year. Meeting these rules is the first step to joining a plan.

Enrollment Process

Enrollment usually starts with a formal invitation or notice. Executives complete enrollment forms, either online or on paper. Some plans have specific enrollment periods each year. New executives may enroll after a waiting period. The process is simple and designed to protect personal information.

Contribution Limits

Plans set yearly limits on contributions. These limits include both employer and employee amounts. The IRS updates contribution limits regularly. Staying within limits avoids penalties and tax issues. Executives should check limits each year to plan savings wisely.

Maximizing Retirement Savings

Saving enough for retirement is vital for nonprofit executives. A good retirement plan helps grow savings steadily. Smart strategies can boost your retirement funds over time. Small steps add up. Careful planning makes a big difference. Here are key ways to maximize your retirement savings.

Catch-up Contributions

Executives aged 50 or older can save more with catch-up contributions. These extra deposits increase the yearly limit. This helps build a larger retirement fund faster. Use catch-up contributions to take full advantage of your plan.

Diversified Portfolios

Spreading investments reduces risk. Choose different asset types like stocks, bonds, and cash. A balanced mix can protect savings from market ups and downs. Diversify to keep your portfolio steady and growing.

Regular Plan Reviews

Review your retirement plan often. Check if your savings and investments match your goals. Adjust contributions or portfolio choices as needed. Regular reviews keep your plan on the right track. Stay active in managing your retirement future.

Compliance And Regulatory Considerations

Nonprofit executive retirement plans must follow strict rules. Compliance ensures plans run smoothly and legally. Ignoring rules can cause penalties and harm the organization’s reputation. Understanding key regulations helps maintain trust with employees and donors.

Irs Rules

The IRS sets clear rules for nonprofit retirement plans. Plans must meet tax-exempt status requirements. Contributions have limits based on salary and plan type. Distributions follow specific timing and tax rules. Failing IRS rules risks losing tax benefits and facing fines.

Fiduciary Responsibilities

Plan managers hold fiduciary duties. They must act in the best interest of participants. Avoid conflicts of interest and manage funds carefully. Fiduciaries must choose investments wisely and monitor plan performance. Neglecting duties can lead to legal action and financial loss.

Reporting Requirements

Nonprofit retirement plans must submit regular reports. The Form 5500 is a common requirement. Reports disclose plan finances, investments, and operations. Timely and accurate reporting builds transparency. Skipping reports can trigger audits and penalties.

Choosing The Right Plan Provider

Choosing the right plan provider for nonprofit executive retirement plans is important. The right provider ensures smooth plan management and good service. It also helps protect the retirement savings of your key staff. Understanding what to look for makes the decision easier.

Service Offerings

Check the types of retirement plans the provider offers. Some specialize in 403(b) or 457(b) plans. Others provide multiple plan options. Look for features like investment choices and plan customization. Good providers also offer tools for plan administration. These services help keep the plan compliant and effective.

Fee Structures

Understand all fees before choosing a provider. Fees can include setup, administration, and investment costs. Some providers charge a flat fee. Others take a percentage of assets under management. Transparent fees help avoid surprises. Choose a provider with clear, reasonable costs.

Customer Support

Strong customer support is key. Your staff should get help when needed. The provider should offer easy access to support by phone or email. Look for providers that offer training and educational resources. Good support improves plan participation and satisfaction.

Credit: www.sensiblemoney.com

Frequently Asked Questions

What Retirement Plans Suit Non Profit Executives Best?

Non profit executives often choose 403(b) or 457(b) plans for tax benefits and flexibility.

How Do Non Profit Retirement Plans Differ From Corporate Plans?

Non profit plans usually have different tax rules and may offer lower contribution limits.

Can Non Profit Executives Contribute More To Retirement Plans?

Some plans allow higher contributions for executives, especially catch-up contributions after age 50.

What Tax Benefits Exist For Non Profit Retirement Plans?

Contributions often reduce taxable income, and earnings grow tax-deferred until withdrawal.

How To Start A Retirement Plan For Non Profit Leaders?

Work with a financial advisor to choose a plan that fits your non profit’s rules.

Conclusion

Nonprofit executives need solid retirement plans for their future. These plans help secure income after work ends. Choosing the right plan can reduce tax burdens and save money. It also supports long-term financial goals. Employers and leaders should review options regularly.

Planning early makes retirement less stressful and more stable. Good retirement plans show care for nonprofit leaders. Start planning today to protect tomorrow.