Mercy Health Retirement Plan: Maximize Your Benefits Today

Are you ready to secure your future with a retirement plan that truly works for you? The Mercy Health Retirement Plan is designed to help you build financial stability and peace of mind as you plan for your golden years.

Whether you’re just starting your career or getting closer to retirement, understanding how this plan benefits you can make a big difference. Keep reading to discover how the Mercy Health Retirement Plan can support your goals and give you confidence in what’s ahead.

Mercy Health Retirement Plan Basics

What Is The Mercy Health Retirement Plan?

This plan is a retirement savings program for Mercy Health workers. It allows employees to put aside money from their paychecks. The money grows with interest and investments until retirement.Who Can Join The Plan?

Most Mercy Health employees can join the retirement plan. There may be some waiting periods before enrollment. The plan is open to full-time and part-time workers in many roles.How Does The Plan Work?

Employees choose how much money to save each pay period. The money is taken before taxes, lowering taxable income. Mercy Health often adds extra funds to help your savings grow.Types Of Investments Available

The plan offers different investment options. You can pick safer choices or ones with more risk and higher returns. It is important to choose options that match your comfort level.When Can You Access Your Savings?

You can take money out after retirement age. Early withdrawals may have penalties and taxes. The plan aims to provide income during your retirement years.

Credit: hallbenefitslaw.com

Eligibility And Enrollment

Who Is Eligible For The Mercy Health Retirement Plan?

Employees who work at Mercy Health can usually join the plan. Most full-time workers qualify after a certain time. Part-time workers may have different rules. New hires often become eligible after completing a probation period. The plan sets a minimum age and work hours needed to join. Check your employee handbook for exact details.How To Enroll In The Mercy Health Retirement Plan

Enrollment starts after meeting eligibility criteria. The human resources team provides the enrollment forms and instructions. Employees fill out the forms and submit them as directed. Some workplaces offer online enrollment for convenience. Deadlines for signing up exist to avoid missing out on benefits. Early enrollment helps build retirement savings faster.Enrollment Periods And Important Dates

The plan has specific enrollment periods each year. New employees have a window to join soon after starting work. Annual open enrollment allows current workers to make changes. Mark the dates on your calendar to stay on track. Missing deadlines might delay your participation. Staying informed ensures you get full plan benefits.Contribution Options

The Mercy Health Retirement Plan offers several ways to contribute. These options help employees save for retirement with ease. Understanding each choice allows for better planning and growth of savings.

Employee Contributions

Employees can choose to contribute a portion of their paycheck. Contributions are deducted automatically from the salary. This makes saving simple and consistent over time.

Employer Contributions

Mercy Health may add extra funds to the retirement plan. These contributions boost the total savings. Employer contributions often depend on the employee’s own input.

Catch-up Contributions

Employees aged 50 or older can add extra money. This helps those closer to retirement save more quickly. Catch-up contributions increase the yearly saving limit.

Roth And Traditional Options

The plan offers both Roth and traditional contribution types. Roth contributions are made after taxes. Traditional contributions reduce taxable income now but get taxed later.

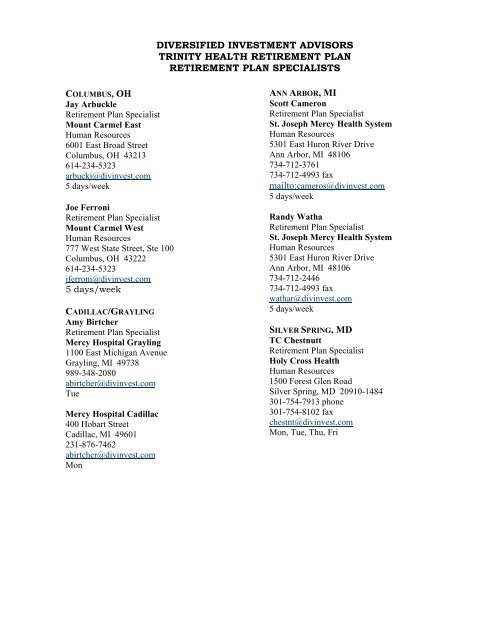

Credit: www.yumpu.com

Investment Choices

Target Date Funds

Target date funds adjust automatically as you near retirement. They start with higher risk and shift to safer investments. This option suits those who prefer a hands-off approach.Stock Funds

Stock funds invest in shares of companies. They offer growth potential but come with higher risk. Ideal for those with longer time until retirement.Bond Funds

Bond funds focus on loans made to governments or companies. They provide steady income and lower risk than stocks. Suitable for more conservative investors.Stable Value Funds

Stable value funds aim to preserve capital and provide steady returns. They offer low risk and stable growth. Perfect for those near retirement or risk-averse.Self-directed Brokerage Account

This option allows more control over your investments. You can pick from a wider range of stocks, bonds, and funds. Best for experienced investors who want flexibility.Maximizing Employer Matching

Understand Your Employer Match Policy

Mercy Health usually matches a percentage of your contributions up to a limit. This limit is often a portion of your salary. Knowing this limit helps you contribute the right amount to get the full match. Missing the limit means missing free money.Contribute Enough To Get The Full Match

Contribute at least the amount Mercy Health matches. For example, if they match 5% of your salary, contribute 5% or more. This way, you receive the full match every pay period. Small increases in your contribution can add up over time.Contribute Early And Consistently

Start contributing as soon as possible in the year. Spreading your contributions evenly avoids missing matches. Consistency helps build a habit and maximizes employer contributions. Don’t wait until the end of the year to increase your savings.Review Your Contributions Regularly

Check your contributions at least once a year. Adjust if your salary changes or if you get a raise. This keeps your contributions aligned with the match limits. Staying updated ensures you don’t lose any matching funds.Retirement Benefit Payouts

The Mercy Health Retirement Plan offers clear and reliable retirement benefit payouts. These payouts provide steady income to support your life after work. Understanding how these benefits are paid helps you plan better for your future. The plan ensures payments are made on time and follow set rules. This brings peace of mind, knowing your retirement income is secure. Each payout depends on your years of service and contributions.

How Retirement Benefits Are Calculated

Retirement benefits depend on your salary and time worked. The plan uses a formula to figure out your monthly payout. More years and higher salary mean larger payments. This method keeps things fair for all members.

Payment Options Available

The plan offers several payment choices. You can get monthly payments for life or a lump sum. Some choose to combine both options. Each choice suits different needs and lifestyles.

When Payments Begin

Payments usually start after you retire. The exact timing depends on your age and service. Early retirement may reduce monthly amounts. Waiting longer can increase your payout size.

Tax Treatment Of Retirement Benefits

Retirement payouts may be taxable income. The plan follows federal and state tax rules. It’s smart to understand tax impacts on your benefits. Planning helps you keep more of your money.

Tax Advantages

The Mercy Health Retirement Plan offers several tax benefits that help you save more for the future. These advantages reduce the amount of tax you pay today. They also help your savings grow faster over time. Understanding these benefits can help you make better decisions for your retirement.

Tax-deferred Growth

Your contributions to the Mercy Health Retirement Plan grow tax-deferred. This means you do not pay taxes on the money as it grows. Taxes are only due when you withdraw funds during retirement. This allows your savings to compound faster without yearly tax deductions.

Pre-tax Contributions

Contributions to the plan are made before taxes. This lowers your taxable income each year. You pay less tax now and save more in your retirement account. It is an easy way to reduce your tax bill while saving money.

Tax Benefits On Withdrawals

Withdrawals from the plan are taxed at your income tax rate in retirement. Many people pay less tax during retirement than while working. This can reduce the total tax you pay over your lifetime. Planning your withdrawals can increase your savings.

Planning For Long-term Security

Understanding Your Mercy Health Retirement Benefits

The plan provides a clear path to retirement income. It includes options like pensions and savings accounts. Knowing your benefits helps you make smart choices. You can check how much money you will receive. This knowledge helps you set realistic goals for your future.Choosing The Right Investment Options

The plan offers different investment choices to grow your savings. Some options are safer, others may earn more money over time. Balance risk and reward based on your comfort level. Regularly review your investments to keep your plan on track. Small changes can make a big difference in your retirement funds.Creating A Withdrawal Strategy

Plan how and when to take money from your retirement accounts. A good strategy ensures your money lasts through retirement. It helps avoid running out of funds too soon. Consider taxes and other costs when deciding withdrawals. This approach keeps your finances steady and reliable.

Credit: www.press-citizen.com

Frequently Asked Questions

What Is The Mercy Health Retirement Plan?

The Mercy Health Retirement Plan helps employees save money for retirement through regular contributions.

Who Is Eligible For The Mercy Health Retirement Plan?

Employees of Mercy Health who meet service and age requirements can join the retirement plan.

How Does Mercy Health Match Retirement Contributions?

Mercy Health matches a portion of employee contributions up to a set limit each year.

Can I Change My Mercy Health Retirement Plan Contributions?

Yes, employees can adjust their contribution amounts during specific times or life events.

When Can I Withdraw Money From The Mercy Health Retirement Plan?

Withdrawals are allowed after reaching retirement age or under certain hardship conditions.

Conclusion

Mercy Health Retirement Plan helps secure your future income. It offers clear options for saving and growing your money. You can plan your retirement with confidence and ease. Understanding the plan’s benefits makes retirement less stressful. Take time to review your choices and stay informed.

Your financial well-being deserves careful attention today. Plan smartly and enjoy peace of mind tomorrow. Retirement readiness starts with simple, steady steps forward.