Balance Forward Retirement Plan: Maximize Your Future Savings

Are you worried about how to keep your retirement savings on track? The Balance Forward Retirement Plan might be the answer you’ve been searching for.

It’s designed to help you manage your funds clearly and confidently, so you always know where you stand. Imagine having a simple, reliable way to see your progress and make smart decisions for your future. If you want to take control of your retirement without confusion or stress, keep reading.

This guide will show you exactly how the Balance Forward Retirement Plan can make your retirement planning easier and more effective.

What Is A Balance Forward Retirement Plan

A Balance Forward Retirement Plan helps manage your retirement savings smoothly. It shows the amount carried over from one period to the next. This plan keeps track of your contributions and earnings over time.

It provides a clear view of your retirement account balance. The balance forward amount updates after each transaction or statement period. This way, you always know how much money you have saved.

How Does A Balance Forward Retirement Plan Work?

Each time you add money or withdraw funds, the balance changes. The plan calculates a new balance by adding deposits and subtracting withdrawals. It also includes any interest or investment gains. This updated balance becomes the new balance forward.

Benefits Of Using A Balance Forward Retirement Plan

This plan simplifies tracking your retirement funds. It helps avoid confusion about your current balance. You can see exactly how your savings grow over time. It also helps with planning your future withdrawals carefully.

Who Should Use A Balance Forward Retirement Plan?

Anyone saving for retirement can use this plan. It suits employees and self-employed individuals alike. It works well for those who want clear, organized account records. People who prefer simple tracking find it very helpful.

Credit: www.reddit.com

Benefits Of Using Balance Forward Plans

Balance Forward Retirement Plans offer clear advantages for managing retirement savings. They help keep track of your money easily. These plans make it simple to see how much you save over time.

Using a Balance Forward Plan reduces confusion. It shows the starting balance and adds new contributions. This helps you understand your retirement fund growth step by step.

Clear Tracking Of Contributions And Earnings

Balance Forward Plans show all deposits and interest earned. You see each amount added to your balance. This clear record helps avoid mistakes in your savings.

Easy Calculation Of Retirement Savings

The plan automatically updates your balance forward. You do not need to calculate totals yourself. This saves time and reduces errors.

Improved Budgeting For Retirement

Knowing your balance helps plan future expenses. You can decide how much to save each month. It supports better financial decisions.

Simple Record Keeping For Taxes

Balance Forward Plans keep clear records for tax reports. This makes filing taxes easier. It provides proof of your contributions and earnings.

Better Understanding Of Fund Growth

Watching your balance grow motivates saving. It shows progress in a simple way. This encourages steady contributions to your retirement.

How To Set Up Your Plan

Setting up a Balance Forward Retirement Plan starts with clear steps. Each step helps you build a solid foundation for your future savings. The process is simple and easy to follow.

Taking time to set up your plan correctly ensures smooth management later. It also helps avoid errors and confusion. Below are the key steps to set up your plan.

Choose The Right Plan Type

Select a Balance Forward Plan that fits your income and goals. Different plans offer various benefits and rules. Understand each type before making your choice.

Gather Important Documents

Collect necessary paperwork like identification, income proof, and tax forms. These documents speed up the setup process. Keep them ready for easy access.

Set Up Your Account

Create your retirement account through the provider’s website or office. Provide accurate personal and financial information. Double-check details before submitting.

Define Contribution Amounts

Decide how much money to contribute regularly. Balance Forward Plans allow flexible contributions. Choose an amount that fits your budget and goals.

Review And Confirm Plan Details

Look over your plan details carefully. Ensure all information is correct. Confirm your choices to activate the plan.

Strategies To Maximize Contributions

Maximizing contributions to your Balance Forward Retirement Plan helps build a stronger financial future. Small steps taken regularly can grow your savings over time. Focusing on smart strategies improves your retirement security and peace of mind.

Knowing how to contribute more allows you to take full advantage of your plan’s benefits. Each dollar added today can lead to greater income after retirement. Here are practical ways to increase your contributions effectively.

Increase Contributions Gradually

Start by raising your contribution amount a little each year. Even a small increase can add up over time. This method avoids feeling a big impact on your monthly budget. It helps you save more without stress.

Take Advantage Of Employer Matching

Check if your employer offers matching contributions. Employer matches are free money added to your plan. Always contribute enough to get the full match. Missing out means leaving money on the table.

Set Up Automatic Increases

Use automatic escalation features if your plan allows. This option raises your contributions by a set percent yearly. It keeps your savings growing without extra effort. Automation helps maintain discipline in saving.

Contribute Windfalls And Bonuses

Put any extra money, like bonuses or tax refunds, into your plan. These lump sums boost your balance quickly. It is a smart way to grow savings without changing your regular budget. Every extra dollar counts.

Review And Adjust Annually

Look over your contribution levels once a year. Life changes might allow you to save more. Adjusting your contributions keeps your plan aligned with your goals. Regular reviews ensure steady progress toward retirement.

Common Mistakes To Avoid

Choosing the right retirement plan is important. The Balance Forward Retirement Plan offers many benefits. Avoiding common mistakes helps you save more and stress less. Simple errors can reduce your savings or cause tax problems.

Understanding these mistakes early keeps your plan on track. Here are some key errors to avoid.

Not Contributing Enough

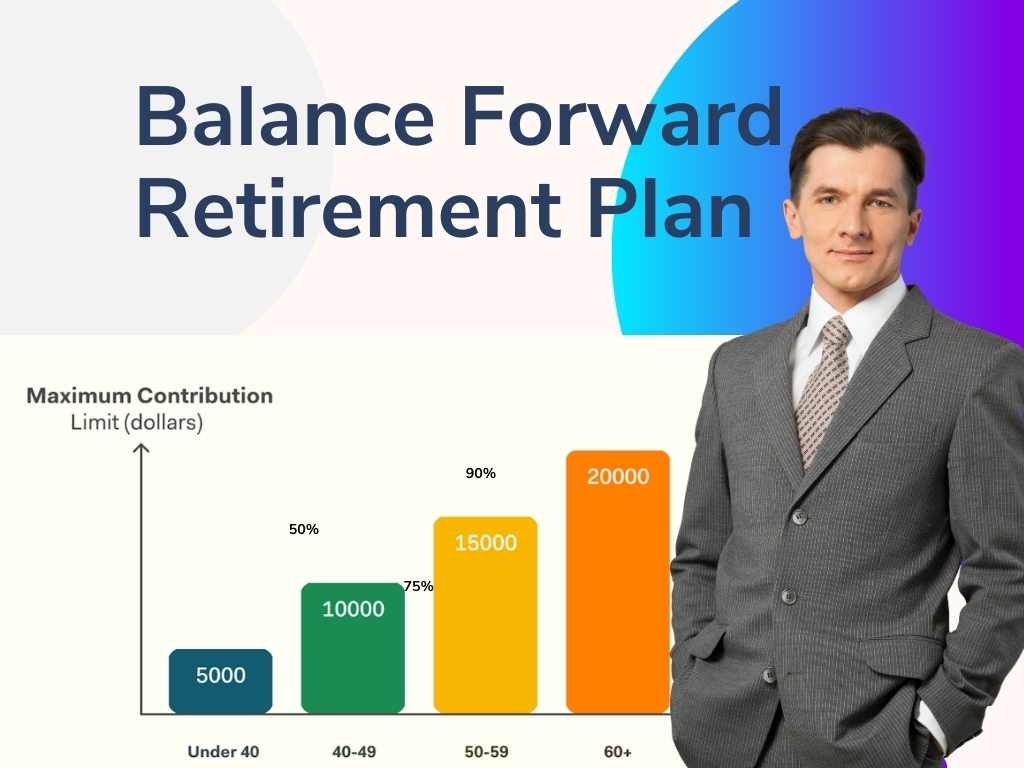

Many people do not put enough money into their retirement plan. Small contributions add up over time. Try to contribute the maximum allowed. It helps your savings grow faster.

Ignoring Plan Deadlines

Missing deadlines for contributions or paperwork can cause trouble. The plan has specific dates for actions. Mark these on your calendar. Staying on time avoids penalties.

Withdrawing Funds Early

Taking money out before retirement can lead to fees and taxes. It also reduces your future savings. Avoid early withdrawals unless it is an emergency.

Failing To Update Beneficiaries

People often forget to update their beneficiary information. Life changes like marriage or divorce require updates. Check your beneficiaries regularly to keep your plan accurate.

Not Reviewing Investment Choices

Investment options in the plan need regular review. Risk levels and market conditions change. Adjust your choices to fit your age and goals.

Tracking And Adjusting Your Savings

Tracking and adjusting your savings is key to a strong Balance Forward Retirement Plan. Savings need regular checks to stay on course. Life changes and market shifts can affect your plan. Small changes in your savings can make a big difference over time.

Knowing how to track progress helps keep your goals clear. Adjusting your savings ensures your retirement plan stays realistic and effective. Let’s explore the best ways to track and adjust your savings.

Using Tools To Monitor Your Savings

Several tools help track your Balance Forward Retirement Plan. Online calculators show how much you have saved. Mobile apps give quick updates anytime. These tools show growth and highlight shortfalls. Tracking tools make saving easier and more accurate.

Reviewing Your Plan Regularly

Set a schedule to review your savings every few months. Regular checks catch problems early. Review your contributions and investment returns. Make sure your savings match your retirement goals. Regular reviews keep you in control of your future.

Adjusting Contributions Based On Needs

Change your savings amount if your income changes. Increase contributions after a raise. Reduce them during hard times but avoid stopping completely. Adjustments keep your plan flexible and realistic. Small boosts now can secure a better retirement.

Responding To Market Changes

Market ups and downs affect your savings value. Stay calm and avoid panic selling. Consider rebalancing your investments to reduce risk. Adjust plans to match new market conditions. This approach protects your savings and growth potential.

Credit: www.plansponsor.com

Frequently Asked Questions

What Is A Balance Forward Retirement Plan?

A Balance Forward Retirement Plan tracks leftover funds from past years for future use.

How Does Balance Forward Affect Retirement Savings?

It helps roll over unused retirement funds, keeping your savings intact over time.

Can I Transfer Balance Forward Funds To Another Plan?

Yes, Balance Forward funds can often move to new retirement accounts.

What Are The Tax Benefits Of Balance Forward Plans?

These plans typically delay taxes until you withdraw your retirement money.

Who Should Consider A Balance Forward Retirement Plan?

People wanting to keep and use leftover retirement funds later should consider it.

Conclusion

A Balance Forward Retirement Plan helps manage your savings clearly. It shows what you start with and what you add or spend. This keeps your money organized and easy to track. You can plan better for your future needs. Staying informed about your balance makes retirement less stressful.

Simple steps today lead to a secure tomorrow. Keep your records updated and review them often. This way, you stay in control of your retirement funds. A clear plan brings peace of mind and confidence.