Best Retirement Plans for Small Nonprofits_ Top Picks for 2025

Planning for retirement can feel overwhelming, especially when you run a small nonprofit. You want to take care of your team’s future, but finding the right retirement plan that fits your budget and mission isn’t always easy.

What if you could discover simple, effective options that help your employees save for their future without stretching your resources? This guide will walk you through the best retirement plans tailored just for small nonprofits like yours. Keep reading to find out how you can secure a brighter tomorrow for your staff—and your organization.

Types Of Retirement Plans

Choosing the right retirement plan helps small nonprofits support their employees’ futures. Different plans offer various benefits and rules. Understanding these types helps find the best fit for your organization.

401(k) Plans

401(k) plans let employees save money before taxes. Employers can add matching contributions. These plans often have higher setup costs. They suit nonprofits wanting flexible savings options and employee involvement.

403(b) Plans

403(b) plans work well for nonprofits with tax-exempt status. They allow employees to save for retirement through salary deferrals. Employers may contribute as well. These plans have simpler rules than 401(k)s.

Simple Ira

Simple IRA plans are easy to set up and manage. They suit small nonprofits with fewer than 100 employees. Employers must contribute, either by matching or fixed amount. Employees save money before tax, growing funds for retirement.

Sep Ira

SEP IRA plans benefit nonprofits with irregular income. Employers make contributions only. Contributions are tax-deductible and flexible each year. This plan is simple and low-cost, ideal for small organizations.

Credit: nonprofithub.org

Key Features To Compare

Choosing the best retirement plan for a small nonprofit requires careful thought. Comparing key features helps find the right fit for your organization and employees. These features affect costs, benefits, and ease of use. Understanding each factor clearly can save money and reduce headaches. Focus on what matters most to your nonprofit’s goals and budget. Here are the main features to compare.

Contribution Limits

Contribution limits set how much employees and employers can put into the plan. Higher limits allow for more savings over time. Some plans have fixed maximums, while others adjust yearly. Check the limits to ensure they meet your team’s needs.

Employer Matching

Employer matching means the nonprofit adds money based on employee contributions. This can motivate staff to save more. Matching varies by plan type and budget capacity. Decide if your nonprofit can afford to match and at what rate.

Administrative Costs

Administrative costs cover managing the retirement plan. These fees affect the total cost to the nonprofit. Look for clear, reasonable fees without hidden charges. Lower costs free up more funds for employee benefits.

Compliance Requirements

Compliance requirements involve legal rules and paperwork for retirement plans. Some plans need more documentation and testing. Ensure your nonprofit can handle these tasks or hire help. Staying compliant avoids penalties and protects your nonprofit.

Top Plans For Small Nonprofits

Best For Flexibility

The SIMPLE IRA plan works well for small nonprofits. It lets employers and employees contribute easily. Employers can choose to match contributions or make fixed payments. This plan has fewer rules and less paperwork. Employees enjoy easy access to their savings. The SIMPLE IRA adapts to changing budgets and staff needs.Best For Low Costs

The SEP IRA is ideal for nonprofits on tight budgets. It has low setup and maintenance fees. Employers make contributions only when they can afford it. No annual filing is required, saving time and money. This plan suits nonprofits with fluctuating income. It keeps costs down while still offering retirement benefits.Best For Employee Participation

The 403(b) plan encourages high employee involvement. It allows workers to save money directly from their paychecks. Employees control their investment choices in this plan. Employers can add matching contributions to boost savings. This plan motivates staff to take charge of their future. It creates a culture of saving and security.Tax Benefits And Incentives

Small nonprofits can gain much from retirement plans. Tax benefits and incentives help reduce costs. These advantages make saving for retirement easier for both employers and employees. Understanding these benefits helps nonprofits choose the best plan.

Tax Deductions For Employers

Employers can deduct their contributions to retirement plans. This lowers their taxable income. Nonprofits save money by reducing their tax bills. Contributions to plans like 403(b) or SIMPLE IRAs qualify. This makes offering retirement benefits affordable for small nonprofits.

Tax Advantages For Employees

Employees enjoy tax savings on their retirement contributions. Money goes into the plan before taxes are taken out. This lowers their taxable income each year. Earnings grow tax-free until withdrawal. These tax advantages encourage employees to save more for retirement.

Government Credits

Some nonprofits qualify for government tax credits. These credits help cover start-up costs of retirement plans. The IRS offers the Retirement Plans Startup Costs Credit. It can cover up to 50% of eligible expenses. This support helps small nonprofits begin retirement plans with less expense.

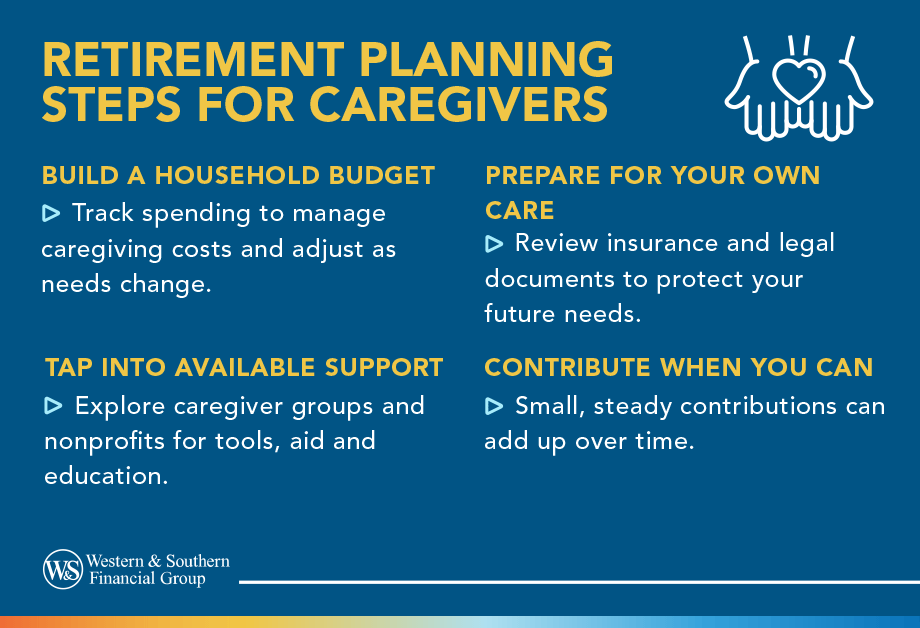

Setting Up And Managing Plans

Setting up and managing retirement plans for small nonprofits requires careful steps. These plans help staff save for the future. Managing them well ensures smooth operation and benefits for everyone. Understanding key parts like choosing providers, ongoing maintenance, and employee support is vital.

Choosing A Provider

Select a provider with experience serving small nonprofits. Look for low fees and clear plan options. Check if they offer easy online tools. A good provider helps with paperwork and compliance. Ask about customer service and support availability. Compare a few providers before making a decision.

Ongoing Plan Maintenance

Keep the plan updated with current laws and rules. Review fees and investment options regularly. Ensure contributions are processed on time. Track participation rates and plan performance. File necessary reports and documents each year. Maintain clear records for audits and reviews.

Employee Education And Support

Teach employees about plan benefits and choices. Offer simple guides and regular meetings. Answer questions and provide resources for savings tips. Help employees understand how to enroll and contribute. Support boosts participation and helps staff feel valued. Make learning easy and ongoing.

Credit: www.visionretirement.com

Credit: www.westernsouthern.com

Frequently Asked Questions

What Are The Best Retirement Plans For Small Nonprofits?

The best retirement plans for small nonprofits include SIMPLE IRA, SEP IRA, and 403(b) plans. These options offer tax advantages and easy administration, ideal for organizations with limited resources and smaller staff.

How Does A Simple Ira Benefit Small Nonprofit Employees?

A SIMPLE IRA allows small nonprofits to contribute pre-tax funds for employees’ retirement. It offers low setup costs and easy management, making it a popular choice for organizations with fewer than 100 employees.

Can Small Nonprofits Offer 403(b) Retirement Plans?

Yes, small nonprofits can offer 403(b) plans, which are tax-deferred retirement accounts designed for tax-exempt organizations. They provide flexible contribution options and are suitable for nonprofits seeking a formal retirement program.

What Is The Difference Between Sep Ira And Simple Ira?

A SEP IRA is employer-funded, ideal for businesses with variable income. SIMPLE IRA allows both employer and employee contributions, suitable for small nonprofits wanting to involve employees in saving.

Conclusion

Choosing the right retirement plan helps small nonprofits support their team well. Plans like SIMPLE IRA and 403(b) offer good options. They balance ease, cost, and benefits. Small nonprofits can save money and attract workers this way. Careful planning today leads to financial security tomorrow.

Take time to compare plans and pick what fits best. A smart choice builds a stronger, happier workplace. Retirement planning is a step toward lasting success.