Aggressive Retirement Plan: Maximize Wealth Fast and Secure Your Future

Are you ready to take control of your future and retire faster than you ever imagined? An aggressive retirement plan might be exactly what you need.

This strategy isn’t for the faint-hearted—it requires focus, smart decisions, and a bit of boldness. But if you’re willing to commit, it can help you build wealth quickly and enjoy the freedom you deserve. Keep reading to discover how to create an aggressive retirement plan that works for you and unlock the steps to financial independence sooner than you think.

Setting Ambitious Retirement Goals

Setting ambitious retirement goals is key to an aggressive retirement plan. Clear, bold goals help guide your saving and investing choices. They give you a target to aim for and keep you motivated.

Strong goals push you to save more and plan better. They also help you understand the risks you must take. Without clear goals, retirement can feel uncertain and stressful.

Determining Your Target Retirement Age

Pick an age when you want to stop working. This age shapes your saving timeline and strategy. A younger target means saving more quickly. It also means investing with higher risk for better returns. A later retirement age gives more time to save and grow money safely.

Think about your health, job satisfaction, and personal dreams. These factors affect your ideal retirement age. Write down a realistic but challenging age. This sets a clear deadline for your financial plan.

Estimating Future Financial Needs

Calculate how much money you will need after retirement. Include daily costs, healthcare, travel, and emergencies. Consider inflation, which increases prices over time. A good estimate helps avoid money shortages later.

Use simple tools or talk to a financial advisor. Find a number that feels ambitious but possible. This estimate shapes how much you need to save and invest now.

Balancing Risk And Reward

Aggressive plans require taking more risks for higher rewards. Invest in stocks, real estate, or other growth assets. These can grow your money faster. But they also can lose value in the short term.

Balance risk with safer investments like bonds or savings accounts. Adjust this balance as you get closer to retirement. Higher risk early, lower risk later keeps your plan steady. This mix helps meet your ambitious goals safely.

High-growth Investment Strategies

High-growth investment strategies aim to increase your retirement savings faster. These strategies take more risk but can offer bigger rewards over time. Choosing the right options helps build wealth more quickly. This approach suits those who can accept some ups and downs in the market.

Stocks And Equity Funds

Stocks represent part ownership in a company. They can grow quickly as companies expand. Equity funds pool money from many investors to buy stocks. These funds spread risk across many companies. Stocks and equity funds often offer higher returns than other investments. They can be volatile, so patience is key.

Real Estate Opportunities

Real estate can provide steady income and value growth. Buying rental properties can create monthly cash flow. Real estate investment trusts (REITs) let you invest without owning property directly. Property values may rise over time, increasing your investment’s worth. Real estate adds diversity and can protect against inflation.

Alternative Investments

Alternative investments include assets like commodities, private equity, and cryptocurrencies. These can offer growth outside traditional markets. They often have less correlation with stocks and bonds. Alternatives can increase your portfolio’s potential returns. These investments carry higher risk and may be less liquid.

Maximizing Contributions And Savings

Maximizing contributions and savings is key for an aggressive retirement plan. Saving more early helps build a larger nest egg. Every dollar saved today can grow over time. Focus on smart ways to add money and keep it growing. Small steps can lead to big changes in your future.

Use strategies that fit your budget and lifestyle. Saving aggressively means making the most of every opportunity. Here are practical methods to boost your retirement savings quickly and effectively.

Utilizing Tax-advantaged Accounts

Tax-advantaged accounts reduce the amount of tax you pay. Accounts like 401(k)s and IRAs offer tax benefits. Contributions often lower your taxable income. Earnings grow tax-free or tax-deferred, which helps your money grow faster. Use the full limit allowed each year. Don’t miss out on employer matches in a 401(k). They are free money for your retirement. These accounts make saving more efficient and powerful.

Automating Savings

Automating savings ensures you save without thinking. Set up automatic transfers from your paycheck or bank account. This creates a steady saving habit. Automating stops you from spending what you should save. It also helps you reach goals faster. Start with a small amount and increase it over time. Consistent saving beats occasional large deposits. Automation makes saving easier and less stressful.

Boosting Income Streams

Increasing income speeds up your savings growth. Side jobs or freelance work add extra cash. Use bonuses or tax refunds to boost your savings. Selling unused items can provide quick money. Consider investments that generate passive income. More income means more money to save or invest. Multiple income streams reduce reliance on one source. This approach strengthens your financial security and retirement fund.

Credit: www.youtube.com

Managing Risks In Aggressive Plans

Managing risks in aggressive retirement plans is essential for long-term success. These plans aim for high returns but come with higher risks. Controlling these risks helps protect your savings from big losses. It also keeps your plan on track toward your retirement goals.

Diversification Techniques

Diversification spreads investments across different assets. This reduces the impact if one investment performs poorly. Stocks, bonds, and real estate can all be part of your mix. Aim for variety in industries and regions too. This approach lowers overall risk and smooths out returns.

Market Volatility Preparedness

Market ups and downs are normal in aggressive plans. Prepare by staying calm during drops. Avoid quick reactions based on fear. Regularly review your portfolio to stay aligned with your goals. Use tools like stop-loss orders to limit losses. Staying informed helps you handle market swings better.

Contingency Planning

Have a backup plan for unexpected events. Emergencies or market crashes can affect your savings. Keep some funds in safe, liquid assets. This helps cover expenses without selling investments at a loss. Review your plan yearly to adjust for changes in life or market conditions.

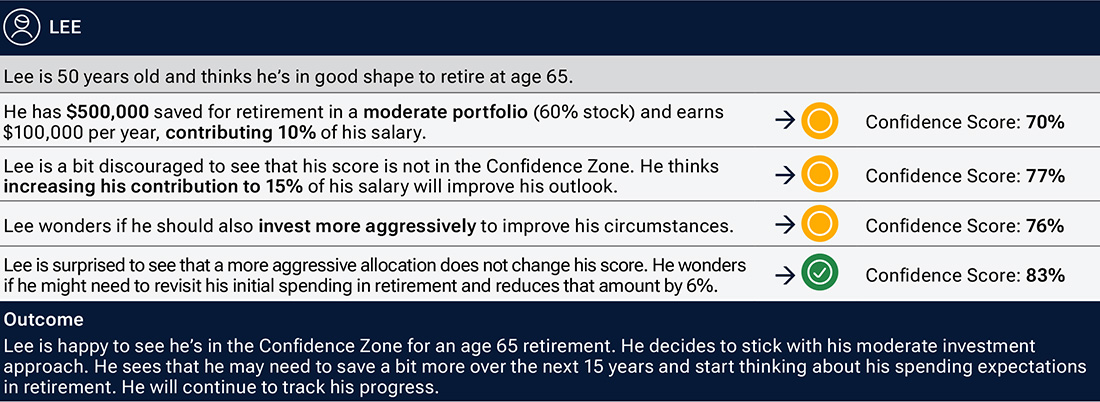

Tracking Progress And Adjusting Tactics

Tracking progress and adjusting tactics is key in an aggressive retirement plan. It helps keep your goals clear and your investments on track. Regular checks allow you to spot issues early and change your plan if needed. Staying flexible can improve your chances of success.

Regular Portfolio Reviews

Check your investment portfolio often. Monthly or quarterly reviews help you see if your assets perform well. This habit helps catch risks or losses early. It also shows if you are on track to meet goals. Use simple tools or apps to track progress easily.

Adapting To Life Changes

Life can change fast. New job, family needs, or health can affect your plan. Adjust your savings or spending to fit these changes. Don’t ignore big life events. Update your retirement plan to stay realistic and achievable.

Rebalancing Investments

Rebalancing means adjusting your asset mix. It keeps your risk level steady. For an aggressive plan, this might mean selling some winners and buying underperformers. Doing this once or twice a year keeps your portfolio balanced. It helps avoid too much risk or too little growth.

Credit: www.troweprice.com

Securing Retirement Income

Securing retirement income is vital for a stress-free future. It means having enough money to cover daily expenses and unexpected costs. A strong plan helps avoid running out of money too soon. Focus on steady income sources and smart withdrawal methods. Protecting your savings from inflation keeps your buying power intact. These steps build a reliable income stream for retirement.

Creating Passive Income Sources

Passive income provides steady cash without constant work. Rental properties can pay monthly rent. Dividend stocks give regular payouts from companies. Peer-to-peer lending earns interest from loans. These sources add money to your retirement fund. Diversify to reduce risk and increase stability. Passive income helps cover bills and keeps savings intact.

Withdrawal Strategies

Withdraw money carefully to make savings last longer. Follow the 4% rule as a starting point. Take only what you need each year. Use a mix of accounts to reduce taxes. Adjust withdrawals if the market drops. Planning withdrawals avoids running out of funds. It keeps your lifestyle steady and worry-free.

Protecting Against Inflation

Inflation reduces the value of money over time. Invest in assets that grow faster than inflation. Stocks and real estate often beat rising prices. Treasury Inflation-Protected Securities (TIPS) guard against inflation. Keep some cash safe but expect its value to drop. Staying ahead of inflation protects your retirement income. Your money keeps its buying power for years.

Credit: www.citizensbank.com

Frequently Asked Questions

What Is An Aggressive Retirement Plan?

An aggressive retirement plan aims for high growth by taking more investment risks.

Who Should Choose An Aggressive Retirement Plan?

Young investors or those with a long time before retirement benefit most from it.

How Much Risk Is Involved In Aggressive Retirement Plans?

These plans carry higher risk due to investments in stocks and growth assets.

Can Aggressive Retirement Plans Lead To Bigger Savings?

Yes, they can grow savings faster but may face bigger ups and downs.

How To Start An Aggressive Retirement Plan Safely?

Start early, diversify your investments, and review your plan regularly for balance.

What Are Common Assets In Aggressive Retirement Plans?

Mostly stocks, mutual funds, and sometimes real estate or other growth-focused investments.

Conclusion

An aggressive retirement plan can help you save faster. It needs focus and regular effort to work well. Start early, invest wisely, and watch your money grow. Stay consistent and adjust your plan as life changes. Risk is part of the journey, but so is reward.

Keep learning and stay patient through ups and downs. Your future self will thank you for taking action today. Small steps add up to big results over time. A clear plan makes retirement goals easier to reach.