Great Eastern Retirement Plan Review: Uncover Benefits & Drawbacks

Are you looking for a retirement plan that offers security and growth for your future? The Great Eastern Retirement Plan might be the solution you need.

Understanding how this plan works can help you make smarter choices with your money. In this review, you’ll discover the key benefits, potential drawbacks, and what sets this plan apart from others. By the end, you’ll have a clearer picture of whether it fits your retirement goals.

Keep reading to find out how the Great Eastern Retirement Plan can help you secure the comfortable retirement you deserve.

Great Eastern Retirement Plan

The Great Eastern Retirement Plan offers a range of useful features. These features help you save money for your future. The plan is designed to fit different needs and goals. It provides flexibility and security for your retirement years. Understanding the key features helps you decide if this plan suits you. The plan focuses on steady growth and protection of your savings. It also offers options to customize your investments based on your comfort level.

Flexible Contribution Options

The plan allows you to choose how much to save each month. You can increase or decrease your contributions as needed. This flexibility helps you manage your budget without stress. It suits both small and larger savers.

Wide Range Of Investment Choices

You can pick from several investment funds under this plan. Options include stocks, bonds, and balanced funds. This variety helps spread risks and improve potential returns. You control where your money grows.

Guaranteed Minimum Returns

The plan offers a guaranteed minimum return on your savings. This feature protects you from market downturns. Your money grows at a steady, safe pace. It adds confidence to your retirement planning.

Tax Benefits

Contributions to the plan may reduce your taxable income. Your investment grows without being taxed yearly. This tax advantage helps your savings grow faster. It is a key benefit for many savers.

Easy Access To Funds

You can withdraw money under certain conditions without penalties. This feature offers financial support during emergencies. It ensures your savings remain accessible if needed. Flexibility is important for peace of mind.

Credit: www.greateasternlife.com

Eligibility Criteria

Great Eastern Retirement Plan requires applicants to be within a certain age range and meet income criteria. Residency status and employment type also affect eligibility. Understanding these factors helps you know if you qualify for the plan.

Who Can Join The Great Eastern Retirement Plan?

The Great Eastern Retirement Plan welcomes individuals who want to save for retirement. It is open to both employees and self-employed persons. Age limits apply to ensure the plan suits your stage in life. Typically, applicants must be between 18 and 65 years old to join.

Residency Requirements

Applicants must live in the country where Great Eastern operates its retirement plans. This rule helps keep the plan compliant with local laws. Proof of residency is usually required during the application process.

Employment Status

Both full-time and part-time workers can apply. Self-employed professionals also qualify for the plan. This flexibility makes it easier for many people to start saving early. Some restrictions may apply depending on your job type.

Minimum Contribution Rules

The plan sets a minimum monthly contribution to keep your account active. This amount varies by plan type and location. Meeting this minimum helps your savings grow steadily over time.

Health And Medical Checks

Most applicants do not need a medical exam. However, some may face health assessments based on age or plan type. These checks help determine eligibility and contribution limits.

Contribution Options

Great Eastern Retirement Plan offers flexible contribution options to suit different budgets. You can choose how much and how often to contribute. This helps you save steadily for your future.

Flexible Contribution Amounts

The Great Eastern Retirement Plan offers flexible contribution amounts. You can choose how much money to put in regularly. This makes it easy to match your budget and savings goals. You can increase or decrease contributions based on your financial situation.

Regular And Lump Sum Contributions

You can contribute regularly through monthly or yearly payments. This helps build your retirement fund steadily. The plan also allows lump sum payments. This option suits those who receive bonuses or extra cash and want to boost their savings quickly.

Employer Contributions

Some plans include employer contributions. Employers add money to your retirement fund as part of your benefits. This extra contribution helps grow your savings faster. Check if your plan offers this feature to maximize your benefits.

Tax Benefits On Contributions

Contributions to the Great Eastern Retirement Plan may qualify for tax benefits. These benefits reduce your taxable income. This means you keep more of your money while saving for retirement. Consult a tax advisor to understand your specific benefits.

Investment Choices

Great Eastern Retirement Plan offers a variety of investment choices. These choices help you build a retirement fund that suits your needs. You can pick options based on your risk comfort and financial goals. The plan aims to give you control over where your money grows. It provides options for both cautious and adventurous investors. This flexibility helps you manage your retirement savings effectively.

Stocks And Equity Funds

Stocks and equity funds focus on long-term growth. They invest in companies with potential to increase in value. This option carries higher risk but can offer higher returns.

Bond And Fixed Income Funds

Bond and fixed income funds provide steady income with lower risk. They invest in government or corporate bonds. This choice suits those who want more stability.

Balanced Funds

Balanced funds mix stocks and bonds. They aim to balance risk and return. This option is good for investors who want moderate growth with some protection.

Money Market Funds

Money market funds invest in short-term, safe instruments. They offer liquidity and lower risk. This option is ideal for conservative investors seeking safety.

Customized Portfolio Options

Great Eastern allows some customization of your portfolio. You can adjust your investments as your goals change. This flexibility helps keep your plan aligned with your needs.

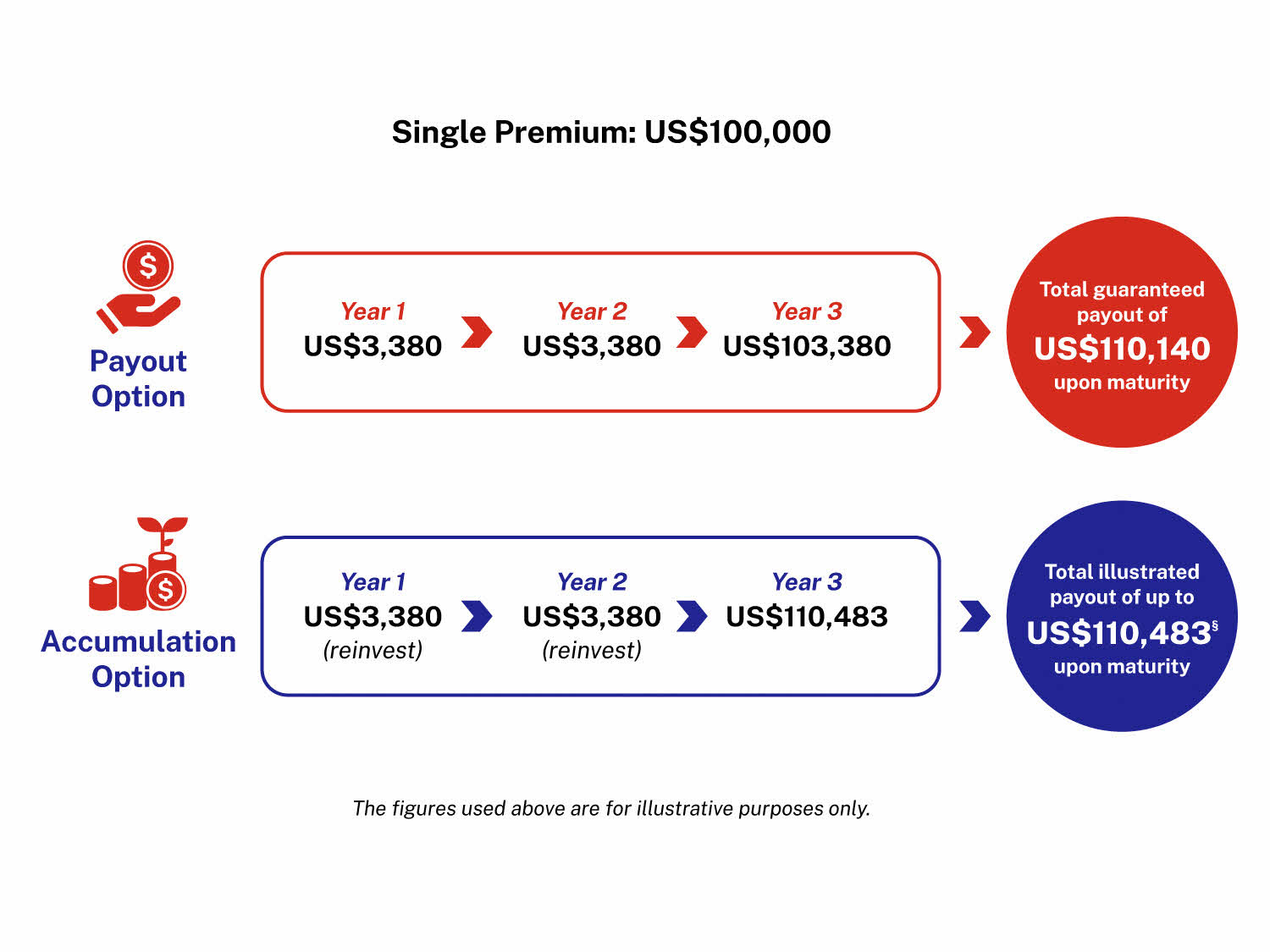

Payout Flexibility

The Great Eastern Retirement Plan offers flexible payout options. This helps retirees manage their income better. They can choose how and when to receive payments. Flexibility gives more control over financial needs after retirement.

Payout Options Available

The plan provides several ways to get your money. You can select monthly, quarterly, or yearly payouts. There is also a lump sum option. These choices allow you to match payouts with your lifestyle.

Adjusting Payout Amounts

You can change your payout amounts over time. If expenses rise, increasing payouts is possible. If you want to save more, reducing payouts works too. This helps keep your finances balanced.

Combining Payout Methods

The plan lets you mix payout methods. You can take part as a lump sum and part as regular payments. This mix suits different financial goals. It offers a steady income plus some extra cash.

Credit: www.greateasternlife.com

Benefits Overview

Flexible Contribution Options

You can choose how much money to put into the plan. This flexibility suits different income levels. You may increase or decrease contributions as needed. It helps you save comfortably without stress.Tax Advantages

The plan offers tax relief on contributions. This means you pay less tax now. Your investment grows tax-free until withdrawal. It helps your savings grow faster over time.Guaranteed Retirement Income

The plan provides a steady income after retirement. This income helps cover daily expenses. It gives peace of mind and financial stability. You know money will come every month.Investment Growth Opportunities

Your money can grow through smart investments. The plan offers a choice of funds. You can select options matching your risk comfort. This helps your savings increase over time.Protection Benefits

The plan includes life and disability protection. This protects your family if something happens to you. It ensures your loved ones receive financial help. A safety net for uncertain times.Potential Drawbacks

Limited Investment Options

The plan offers fewer choices compared to other retirement plans. This can restrict how you grow your savings. Some investors may find the options too simple.Fees And Charges

There are fees involved in the plan. These may reduce your overall returns. It is important to check all costs before deciding.Withdrawal Restrictions

Access to funds might be limited before retirement age. Early withdrawal could lead to penalties. This reduces flexibility in managing your money.Inflation Impact

The plan’s returns may not always keep up with inflation. This can reduce your purchasing power over time. It’s important to consider inflation in retirement planning.

Credit: sg.finance.yahoo.com

Frequently Asked Questions

What Is The Great Eastern Retirement Plan?

The Great Eastern Retirement Plan helps you save money for your future retirement years.

How Does The Great Eastern Retirement Plan Work?

You regularly invest money, which grows over time for use after you retire.

What Are The Benefits Of This Retirement Plan?

It offers steady growth, tax benefits, and financial security during retirement.

Who Should Consider The Great Eastern Retirement Plan?

Anyone wanting a safe, long-term way to prepare financially for retirement.

Conclusion

Great Eastern Retirement Plan offers reliable options for your future. It provides steady growth and flexible choices to suit your needs. You can plan your retirement with clear benefits and simple steps. Trust in a plan that focuses on long-term security.

Start early to enjoy peace of mind later. Retirement planning does not have to be hard. This plan helps you build a solid financial foundation. Make decisions today that support your tomorrow.