Illinois Retirement Plan Mandate: Essential Guide for Employers 2026

Are you ready to take control of your financial future? The Illinois Retirement Plan Mandate is changing the way you and your employees save for retirement.

Whether you’re a business owner or an employee, understanding this new rule is crucial. It affects your paycheck, your savings, and your peace of mind. Keep reading to discover what the mandate means for you and how you can make it work in your favor.

Your retirement security starts here.

Credit: www.reddit.com

Illinois Retirement Plan Mandate Basics

What Is The Illinois Retirement Plan Mandate?

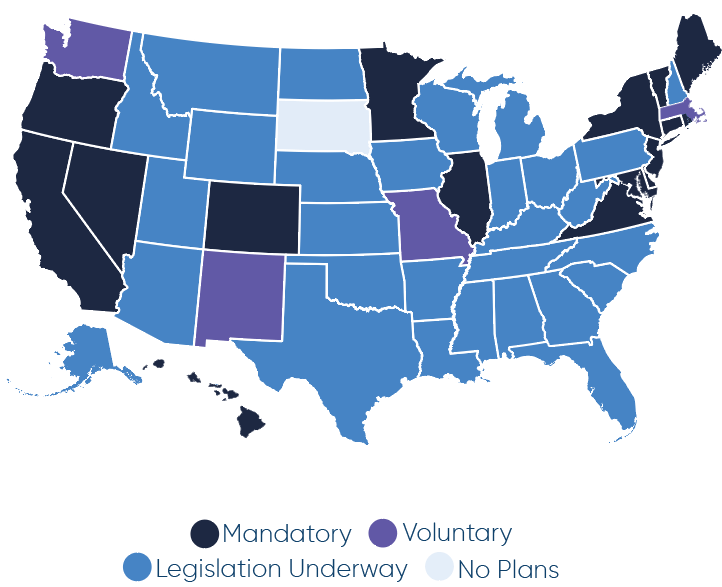

This mandate is a state law that requires employers to provide retirement plans. It applies mainly to businesses that do not already offer a retirement option. The goal is to increase retirement savings among Illinois workers.Who Must Comply?

Employers with at least 25 employees must follow the mandate. These employees must work in Illinois for at least 30 hours a week. Small businesses with fewer than 25 employees are not required to comply now.Types Of Retirement Plans Allowed

Employers can offer different types of plans under the mandate. Common options include 401(k) and IRA plans. These plans allow workers to save money before taxes for retirement.Employee Enrollment Rules

Employees are automatically enrolled but can choose to opt out. Enrollment usually happens after 30 days of employment. This system helps increase participation in retirement savings.Who Must Comply

The Illinois Retirement Plan Mandate requires certain businesses to offer retirement plans to their employees. Knowing who must comply helps employers meet state rules. This section explains who falls under this mandate.

Which Employers Must Comply?

Private employers with 25 or more employees must comply. These businesses need to provide a retirement savings option. This rule applies to all industries and sectors in Illinois.

Employee Eligibility Requirements

Employees aged 18 or older qualify for enrollment. They must work at least 30 hours per week. Part-time workers who meet these hours are included too.

Exemptions From The Mandate

Employers already offering a retirement plan may be exempt. Government agencies and nonprofits might not need to comply. Small businesses with fewer than 25 employees are excluded.

Deadlines For Compliance

Employers must follow a schedule based on their size. Larger employers have earlier deadlines. Smaller qualifying businesses have more time to comply.

Key Deadlines And Timelines

Illinois employers must follow specific deadlines to comply with the retirement plan mandate. Missing these dates can lead to penalties. Knowing the timeline helps businesses stay on track and avoid issues.

Understanding The Illinois Retirement Plan Mandate Deadlines

The Illinois Retirement Plan Mandate sets clear deadlines for employers. These deadlines help businesses comply on time. Missing these dates can lead to penalties or fines. Knowing each key date keeps your business safe and ready. The timeline depends on the number of employees your business has. Smaller companies have later deadlines than larger ones. This staged approach helps businesses prepare gradually.

Initial Registration Deadline

Employers with 25 or more employees must register first. The registration deadline was July 1, 2024. Registration means signing up to offer a retirement plan. This step is mandatory before other actions.

Plan Offering Deadline

After registration, employers must offer a retirement plan. This deadline is December 31, 2024, for large employers. Smaller employers get more time, but must still meet their deadlines. Offering a plan means giving employees access to save for retirement.

Employee Enrollment Timeline

Once the plan is offered, employees can enroll. Employers must allow enrollment within 30 days of offering. This ensures workers can start saving quickly. Early enrollment helps employees build better retirement savings.

Reporting And Compliance Dates

Employers must submit reports yearly to the state. Reports show compliance with the mandate rules. The first report is due by March 31, 2025. Staying current with reports avoids penalties and keeps the plan active.

Plan Options For Employers

The Illinois Retirement Plan Mandate offers several options for employers to help employees save for retirement. Employers must choose a plan that fits their business size and budget. Each plan option has different features and benefits. Understanding these options helps employers comply with the law and support their staff’s future.

Illinois Secure Choice Program

This is a state-run retirement savings program. It is designed for small businesses without a retirement plan. Employers automatically enroll workers, but employees can opt out. Contributions come from workers’ paychecks. Employers do not manage the funds or handle investments.

Private Retirement Plans

Employers can set up private plans like 401(k) or SIMPLE IRA. These plans give more control over investments and contributions. Employers may choose plan providers and manage accounts. They also handle compliance and reporting. These plans often require more effort but offer flexibility.

Multiple Employer Plans (meps)

MEPs allow several small employers to join a single retirement plan. This reduces administrative work and costs. Employers share the plan’s responsibilities. MEPs provide access to professional management and better investment options. This is a good choice for small businesses wanting a private plan.

Enrollment And Communication Requirements

The Illinois Retirement Plan Mandate requires clear steps for enrollment and communication. Employers must follow specific rules to help workers join the retirement plan. This process ensures employees know their options and how to participate. Effective communication is key. It helps employees understand the benefits and how to enroll. Employers must provide easy-to-read materials and timely updates.

Enrollment Process For Employees

Employees must be automatically enrolled in the retirement plan. This means the employer signs them up unless they choose to opt out. The enrollment should happen within a set time after starting work. Workers receive information about contribution rates and how money is saved. This helps them make good decisions about their retirement savings.

Employer Communication Responsibilities

Employers must send clear notices about the retirement plan. These include details on enrollment, how to opt out, and plan benefits. Notices must be in writing and easy to understand. Regular updates about any changes in the plan are also required. This keeps employees informed and confident about their retirement choices.

Timing And Frequency Of Notices

Notices must be sent before enrollment starts. This gives employees time to learn and decide. Employers also need to provide annual reminders about the plan. These communications ensure employees stay engaged with their retirement options year after year.

Penalties For Noncompliance

Failing to follow the Illinois Retirement Plan Mandate can lead to serious penalties. These penalties aim to ensure businesses comply with the law and provide retirement options to employees. Understanding these consequences helps employers avoid costly mistakes. Penalties increase with the length of noncompliance. The state enforces strict rules to protect workers’ retirement benefits. Employers who ignore the mandate may face fines and legal actions.

Financial Penalties For Employers

Employers who do not comply face daily fines. These fines can add up quickly, reaching thousands of dollars. The amount depends on the size of the business and how long it remains noncompliant.

Impact On Business Reputation

Noncompliance can damage a company’s reputation. Workers and customers may lose trust in the business. This loss can affect sales and employee morale over time.

Legal Consequences And Enforcement

State authorities have the power to audit businesses. They can require proof of compliance at any time. Legal actions may follow if a business refuses to comply after warnings.

Steps To Prepare Your Business

Assess Your Business Size And Eligibility

First, check if your business meets the mandate rules. The law applies to businesses with five or more employees. Make sure you count all eligible workers properly. This step avoids confusion later.Choose A Retirement Plan Provider

Select a provider that offers simple and affordable plans. Look for one with easy enrollment and good support. A reliable provider helps you manage the plan well. Compare options before making a decision.Inform Your Employees About The Plan

Communicate clearly with your staff about the new plan. Explain how it works and the benefits it offers. Use simple language to help everyone understand. Give them time to ask questions and enroll.Set Up Payroll Deductions

Work with your payroll team to add retirement contributions. Automate the deductions to avoid errors. Ensure the correct amounts are withheld each pay period. This keeps the plan running smoothly.Monitor Compliance And Deadlines

Track important dates related to the mandate. Submit required reports on time. Keep records of employee participation and contributions. Staying organized helps avoid penalties.

Credit: slavic401k.com

Credit: www.illinoispolicy.org

Frequently Asked Questions

What Is The Illinois Retirement Plan Mandate?

It requires employers without retirement plans to offer a state-run option to employees.

Who Must Comply With The Illinois Retirement Mandate?

Private employers with 25 or more employees must follow the mandate rules.

How Does The Illinois Retirement Plan Benefit Employees?

It helps employees save for retirement through easy and automatic payroll deductions.

When Did The Illinois Retirement Plan Mandate Start?

The program began in 2020, with full employer participation by 2024.

Conclusion

The Illinois Retirement Plan Mandate helps workers save for the future. It offers a simple way to build retirement funds. Employers and employees both share responsibility in this plan. Saving early makes a big difference over time. Small contributions grow into larger savings.

This plan brings security and peace of mind. Taking part means planning for a better tomorrow. Everyone benefits from steady, smart saving habits. Start understanding the rules and how they apply. Retirement feels closer with a clear savings path.