Average Inflation Rate for Retirement Planning: Smart Strategies Revealed

When you think about your future, one number can quietly change everything: the average inflation rate. It’s more than just a percentage—it’s the key to understanding how much your money will really be worth when you retire.

If you want to protect your savings and enjoy the lifestyle you dream of, you need to know how inflation can affect your plans. Keep reading, and you’ll discover simple ways to factor inflation into your retirement strategy, so your hard-earned money stays strong for years to come.

Credit: www.adcb.com

Impact Of Inflation On Retirement

Inflation reduces the value of money over time. This means the money saved today will buy less in the future. For retirees, this can be a big problem. Fixed incomes may not keep up with rising costs. Planning for inflation is key to a secure retirement.

Understanding Inflation’s Effect On Retirement Savings

Inflation eats into the purchasing power of savings. A dollar saved today might be worth less in 10 or 20 years. Retirees may find their savings shrink in real value. This reduces their ability to pay for daily needs.

How Rising Prices Impact Retirement Expenses

Costs for food, healthcare, and housing often rise faster than general inflation. Retirees face higher bills for essential services. Without adjusting for inflation, budgets can fall short. This creates financial stress and harder choices.

The Importance Of Factoring Inflation Into Income Planning

Planning retirement income without inflation leads to shortfalls. Income should grow to match or beat inflation rates. This helps maintain living standards over time. Investments and pensions need strategies to protect against inflation.

Calculating Average Inflation Rates

Understanding average inflation rates is key for retirement planning. Inflation affects the cost of living and savings value. Calculating these rates helps predict future expenses. This helps build a more realistic retirement budget. Calculating average inflation rates involves using past data on price changes. It shows how much prices have risen over time. This gives a clearer picture of how inflation might impact your retirement funds.

What Is The Average Inflation Rate?

The average inflation rate is the yearly increase in prices. It is usually measured by the Consumer Price Index (CPI). The CPI tracks changes in the cost of goods and services. This rate helps estimate future costs for retirees.

How To Calculate Average Inflation Rate

To calculate the average inflation rate, start with the CPI data for each year. Subtract the earlier year’s CPI from the later year’s CPI. Divide the result by the earlier year’s CPI. Multiply by 100 to get the percentage rate. Repeat this for each year in the period. Then, find the average of these yearly rates.

Using Historical Data For Calculation

Historical CPI data is available from government sources. Using 5 to 10 years of data gives a good average. Longer periods can smooth out unusual spikes or drops. This makes the average inflation rate more reliable for planning.

Why Average Inflation Rate Matters For Retirement

Knowing the average inflation rate helps adjust savings goals. It shows how much more money you may need in the future. This protects your retirement income from losing value over time.

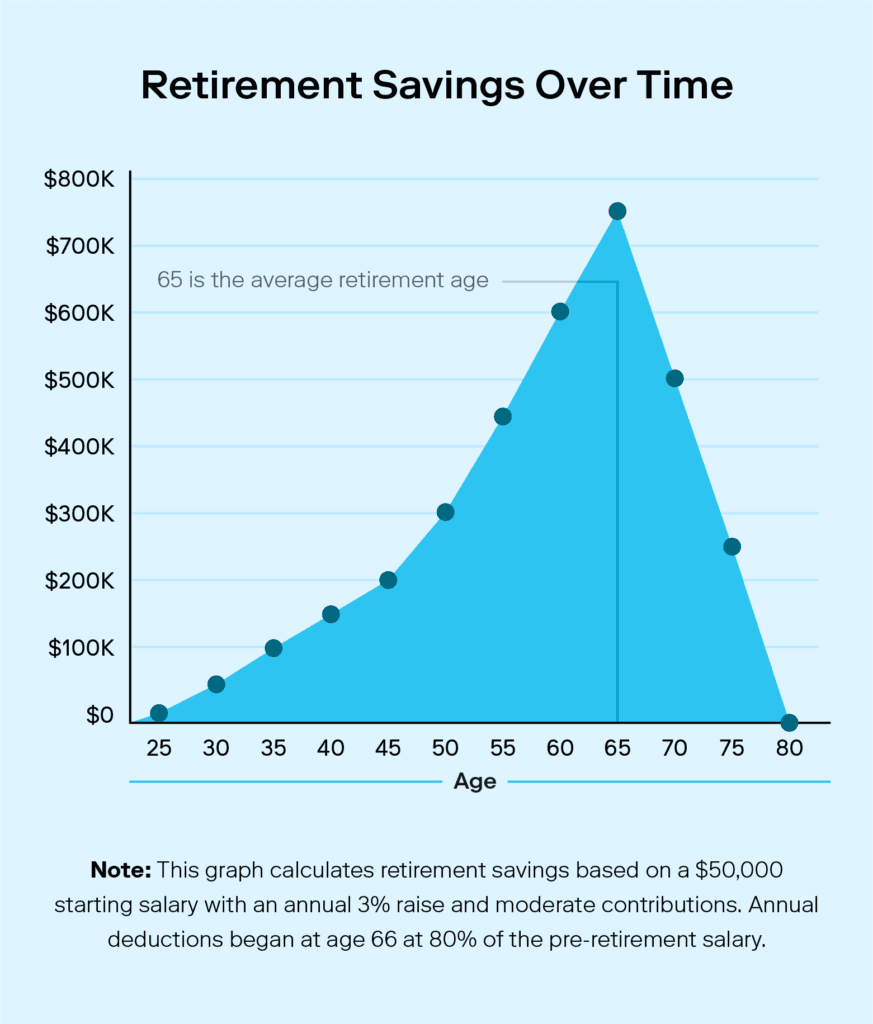

Adjusting Retirement Savings

Adjusting retirement savings is crucial to protect your future income from inflation. Inflation reduces the buying power of money over time. This means your savings must grow enough to keep up with rising prices. Ignoring inflation can cause you to run out of money in retirement. Planning with average inflation rates helps you estimate how much to save. You can then adjust your savings goals to meet future costs.

Understanding Inflation’s Impact On Savings

Inflation makes everyday goods and services cost more each year. If your savings do not increase at the same rate, you lose spending power. For example, a basket of groceries costing $100 today might cost $120 in five years. Without adjusting savings, your fixed income will buy less over time. Understanding this impact guides better saving decisions.

Estimating Future Expenses With Inflation

Estimate how much your retirement expenses will grow due to inflation. Use the average inflation rate to increase current costs annually. This gives a clearer picture of future spending needs. Planning for these higher costs helps you avoid financial shortfalls. It also supports a more comfortable and secure retirement.

Increasing Savings To Match Inflation

Raise your savings contributions to keep pace with inflation. Small, regular increases can make a big difference over time. This approach builds a larger nest egg that holds its value. Consistent adjustments prevent your savings from losing value. It ensures your money supports your lifestyle after retirement.

Choosing Investments That Outpace Inflation

Select investments that grow faster than inflation. Stocks, real estate, and inflation-protected securities are common choices. These assets help your savings maintain or increase their value. Balancing risk and return is important for steady growth. Proper investment choices protect your retirement funds against inflation.

Credit: www.ainvest.com

Investment Options To Beat Inflation

Inflation reduces the value of money over time. Retirement savings must grow faster than inflation. Choosing the right investments helps protect your money. Some options offer returns that can beat inflation. These investments balance risk and reward for steady growth.

Stocks For Long-term Growth

Stocks often grow faster than inflation over many years. Companies increase profits and share prices rise. Dividends provide extra income that keeps up with rising prices. Stocks can be volatile but suit long-term retirement plans.

Real Estate Investments

Property values and rents usually increase with inflation. Real estate offers income and capital growth. Rental income can rise each year, helping cover costs. Physical assets like real estate act as a hedge against inflation.

Inflation-protected Bonds

These bonds adjust their value based on inflation rates. They provide steady income that keeps pace with price increases. Less risky than stocks, they offer protection for conservative investors. Treasury Inflation-Protected Securities (TIPS) are a common choice.

Commodities And Precious Metals

Gold and other commodities often rise in value during inflation. They serve as a store of value when money loses purchasing power. Including some commodities in a portfolio adds diversity and inflation protection.

Budgeting For Inflation In Retirement

Inflation can reduce the value of your money over time. This means your retirement savings might not stretch as far as planned. Budgeting for inflation helps protect your lifestyle after you stop working. Planning ahead allows you to cover rising costs without stress. It keeps your finances balanced and your spending steady. Understanding how inflation affects your budget is key to a secure retirement.

Understanding Inflation’s Impact On Retirement Expenses

Prices for goods and services rise each year. Essentials like food, healthcare, and housing often cost more. These increases can add up and strain your budget. Expect your daily expenses to grow over time.

Adjusting Your Budget For Inflation

Include an inflation rate in your retirement budget. Increase your expected expenses by 2% to 3% annually. This simple step helps keep your budget realistic. Review and update your plan every year.

Choosing Inflation-protected Income Sources

Some retirement income options rise with inflation. Social Security benefits often increase each year. Certain annuities also adjust payments to match inflation. These can help your income keep pace with costs.

Tracking Inflation And Spending Regularly

Monitor price changes and your spending habits. Adjust your budget based on actual inflation rates. This keeps your plan accurate and useful. Tracking helps you avoid surprises in your finances.

Using Inflation-protected Securities

Using inflation-protected securities can help protect retirement savings from rising prices. These investments adjust with inflation. They offer a way to keep your money’s value steady over time. Retirees worry about inflation eating away their income. Inflation-protected securities provide some safety. They pay interest that changes based on inflation rates. This means your returns can increase if prices rise.

What Are Inflation-protected Securities?

Inflation-protected securities are government bonds. They are designed to adjust for inflation. The principal value grows with inflation. Interest payments also rise as inflation increases.

Benefits For Retirement Planning

These securities help maintain purchasing power. They reduce the risk of losing money’s value. They provide steady income during retirement. This helps cover rising living costs over time.

How To Include Them In Your Portfolio

Invest a part of your retirement savings in these bonds. Balance them with other investments for growth. Monitor inflation rates to adjust your holdings. This strategy can make your portfolio more resilient.

Monitoring And Updating Plans

Monitoring and updating your retirement plan is very important. Inflation rates change over time. These changes affect how much money you need in the future. Your plan must grow with these changes to stay effective. Regular checks help catch problems early. This keeps your savings on track. It also helps you adjust goals and spending habits as needed. Monitoring is not just about numbers. It is about your peace of mind.

Understanding Inflation Trends

Keep an eye on inflation trends yearly. Understand how inflation rises and falls. This helps you predict future costs better. Use trusted sources for accurate information. Knowing trends helps you prepare for price increases.

Adjusting Your Savings Goals

Change your savings goals based on inflation data. If inflation rises, you need to save more. If it falls, you might save less. Adjusting goals keeps your retirement funds realistic. Regular updates prevent surprises in later years.

Reviewing Spending Plans

Look over your planned spending often. Inflation can increase daily expenses like food and bills. Check if your budget still fits your expected lifestyle. Adjust spending to avoid running out of money. Small changes now save big problems later.

Consulting Financial Advisors

Talk to a financial advisor for expert advice. They help interpret inflation data correctly. Advisors suggest the best actions for your plan. Their guidance can improve your retirement security. Regular meetings keep your plan aligned with your needs.

Credit: www.stash.com

Frequently Asked Questions

What Is The Average Inflation Rate Used In Retirement Planning?

The average inflation rate is usually around 2-3% per year for long-term planning.

Why Does Inflation Matter For Retirement Savings?

Inflation reduces the buying power of money, so savings need to grow to keep up.

How Can Retirees Protect Savings From Inflation?

Investing in assets like stocks or real estate helps savings grow faster than inflation.

How Often Should I Adjust My Retirement Plan For Inflation?

Review your retirement plan yearly to adjust for changes in inflation and costs.

Conclusion

Planning for retirement means thinking about inflation’s effect on your money. Inflation reduces buying power over time. Saving without considering inflation can cause problems later. Use the average inflation rate to estimate future expenses. Adjust your savings to keep up with rising costs.

Regularly review your plan to stay on track. A clear understanding helps you prepare better. This simple step can protect your financial future. Don’t ignore inflation when planning for retirement.