Largest Retirement Plan Providers in the United States: Top Leaders Revealed

Are you thinking about securing your financial future? Choosing the right retirement plan provider is one of the smartest moves you can make today.

But with so many options out there, how do you know which companies you can trust with your hard-earned money? You’ll discover the largest retirement plan providers in the United States—those trusted by millions to help grow their savings and provide peace of mind.

Understanding who these top players are can make a big difference in how confident you feel about your retirement choices. Keep reading to find out which providers stand out and why they might be the right fit for your needs.

Credit: www.napo.org

Leading Retirement Plan Providers

Vanguard Group

Vanguard is known for low-cost investment options and strong customer service. It serves millions with 401(k), IRA, and other retirement plans. The company focuses on keeping fees low to help savings grow faster.Fidelity Investments

Fidelity offers a wide range of retirement plans for businesses of all sizes. It provides helpful tools and guidance to plan sponsors and participants. Many trust Fidelity for its strong track record and easy-to-use platform.Charles Schwab

Charles Schwab is popular for its simple, flexible retirement plans. It gives access to many investment options and personalized support. Schwab aims to make saving for retirement less complicated.Principal Financial Group

Principal Financial Group focuses on retirement solutions for small to mid-sized businesses. It offers tailored plans that fit different needs and budgets. Their service includes financial advice and plan management.Massmutual

MassMutual provides retirement plans with a focus on life insurance and financial security. It helps employers design plans that protect workers and their families. MassMutual combines retirement savings with risk protection.

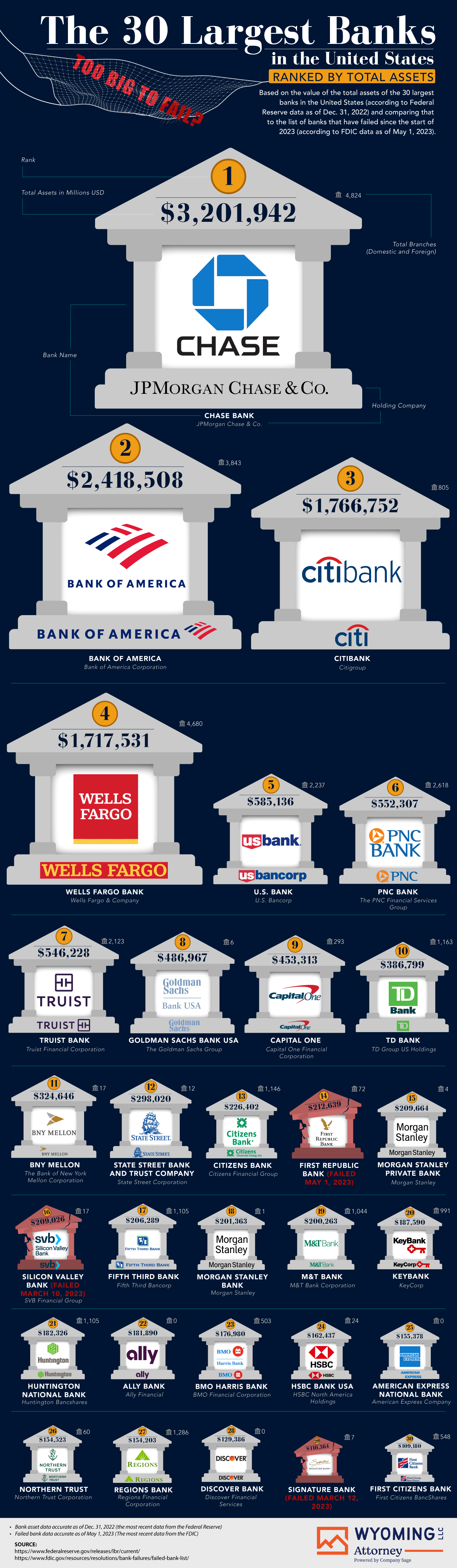

Credit: wyomingllcattorney.com

Market Share And Assets Managed

The retirement plan industry in the United States is vast and competitive. Providers manage trillions of dollars in assets for millions of workers. Market share reflects the size and influence of these companies. Understanding who controls the largest shares helps to see the industry’s landscape. Assets under management (AUM) show how much money these providers hold. A higher AUM means more trust from clients and stronger market presence. The largest providers often lead in both market share and assets managed.

Top Providers By Market Share

Firms like Vanguard, Fidelity, and T. Rowe Price dominate the market. Vanguard leads with a large percentage of the retirement plan market. Fidelity holds a strong second place with a broad client base. These companies attract millions of participants and manage billions in funds.

Assets Managed By Leading Firms

Vanguard manages over $7 trillion in assets, making it the largest retirement plan provider. Fidelity follows closely with assets exceeding $4 trillion. T. Rowe Price and Charles Schwab each manage over $1 trillion. These figures show how much money flows through the top firms annually.

Impact Of Market Share On Retirement Security

Large market share means more resources for customer support and innovation. Providers with high assets can offer better investment options. They can also negotiate lower fees for their clients. This helps workers save more effectively for retirement.

Services Offered By Top Providers

Top retirement plan providers offer many services to help individuals save and plan for retirement. These services focus on ease, flexibility, and growth of retirement funds. Understanding these services helps participants choose the best plan. Providers design plans that suit different types of employers and workers. They offer tools and advice to make saving simple and effective. These services support both employees and employers in managing retirement savings.

Account Management Tools

Providers supply online portals for easy account access. Users can check balances, track investments, and update personal information. These tools often include mobile apps for convenience.

Investment Options

Top providers offer diverse investment choices, including stocks, bonds, and mutual funds. This variety helps participants build a balanced portfolio. Many plans include target-date funds tailored to retirement age.

Financial Education And Advice

Providers give access to workshops, webinars, and articles about saving and investing. Some offer one-on-one counseling or robo-advisors for personalized advice. These resources help participants make informed decisions.

Employer Services

Retirement plan providers assist employers with plan setup and compliance. They handle payroll integration, reporting, and record keeping. This support reduces the employer’s administrative burden.

Customer Support

Providers maintain help desks and chat services to answer questions. They offer multilingual support for diverse participants. Quick and clear support improves the overall user experience.

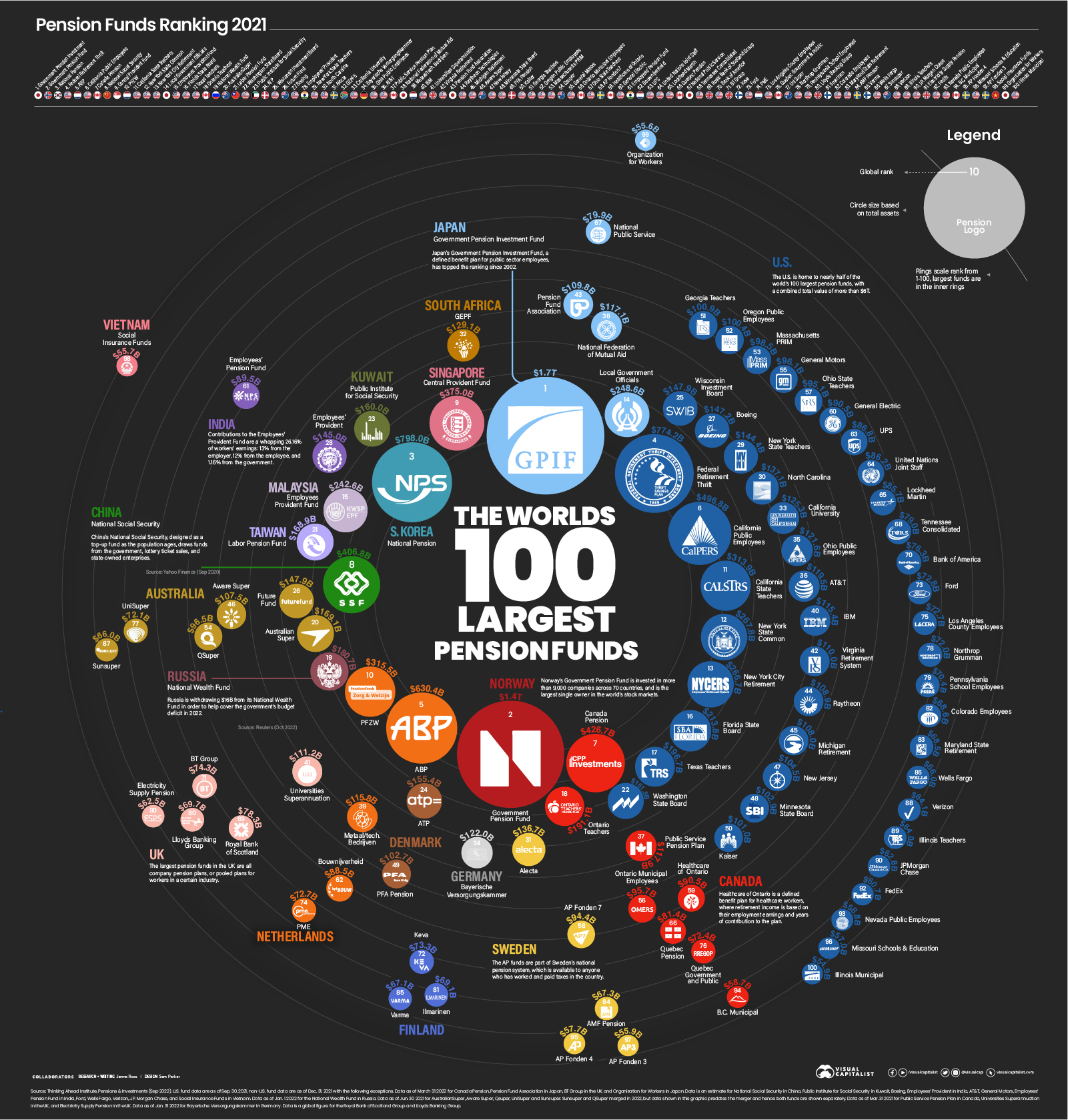

Credit: www.visualcapitalist.com

Technology And Innovation In Retirement Plans

Digital Platforms for Easy Access

Many providers have websites and apps for quick account access. Users can view balances, track progress, and update preferences online. This saves time and reduces the need to call customer service. These platforms often include tools to simulate future savings. People can see how changes in contributions affect their retirement funds. This helps users make better decisions about their money.Automated Investment Options

Retirement plan providers offer automated investing based on personal goals. Robo-advisors choose investments that match risk levels and timelines. This service guides users without needing deep financial knowledge. Automatic rebalancing keeps portfolios on track by adjusting asset mixes. It reduces risk and aims to improve returns over time. People save without constant monitoring.Personalized Retirement Planning Tools

Providers use data to create personalized retirement plans. These tools consider income, expenses, and lifestyle goals. Users receive tailored advice on saving and withdrawing funds. Such tools help with tax planning and estimating social security benefits. They provide a clearer picture of retirement readiness. This leads to smarter financial choices.Customer Satisfaction And Support

Accessibility Of Customer Service

Top providers offer multiple ways to reach support teams. Phone lines open during business hours and live chat options are common. Some even provide 24/7 assistance. Quick responses reduce stress and confusion.Quality Of Support Staff

Support staff with good training make a big difference. They answer questions clearly and patiently. Friendly and knowledgeable teams build trust. Users feel respected and understood during every interaction.Online Resources And Tools

Providers give easy access to tutorials and FAQs online. These tools help users solve problems independently. Clear guides on managing accounts and investments improve user experience. Updated content keeps customers informed.Customer Feedback And Reviews

Many providers collect feedback to improve their service. Positive reviews show satisfaction with the support offered. Negative feedback highlights areas needing work. Providers that listen to customers grow stronger.Future Trends In Retirement Planning

Retirement planning is changing fast. New trends are shaping how people save and invest for their future. Technology, policy, and personal habits all play a part. Understanding these trends helps you prepare better. Here are some key future trends in retirement planning. Technology and Automation Technology is making retirement planning easier. Robo-advisors offer simple, low-cost investment options. Many providers use apps to track savings and give advice. Automation helps people stay on track without constant effort. Focus on Financial Wellness More plans now include education on money habits. Providers help people manage debt, budgeting, and saving. This focus improves overall financial health. Healthy money habits lead to better retirement outcomes. Personalized Retirement Solutions Plans tailor options based on individual needs. Age, income, and job type affect choices. Personalized advice helps people pick the right investments. Customized plans improve confidence and results. Increased Use of ESG Investing Environmental, social, and governance (ESG) investing grows in popularity. Many want investments that reflect their values. Retirement plans now offer ESG funds. This trend blends financial goals with social responsibility. Changes in Retirement Income Strategies People seek new ways to generate steady income. Annuities and other income products get more attention. Plans focus on balancing growth with guaranteed income. This helps retirees feel secure about their money.

Frequently Asked Questions

Who Are The Top Retirement Plan Providers In The Us?

Firms like Fidelity, Vanguard, T. Rowe Price, and Charles Schwab lead the US retirement plan market.

What Types Of Retirement Plans Do These Providers Offer?

They offer 401(k), IRA, Roth IRA, and pension plans tailored to different needs.

How Do Retirement Plan Providers Help Employees Save Money?

They offer low-cost investment options, expert advice, and easy account management tools.

Why Choose Large Providers For Retirement Planning?

Large providers have more resources, better technology, and a wider range of investment choices.

Conclusion

Choosing the right retirement plan provider matters a lot. These top providers offer strong support and reliable services. They help people save money for their future. Each one has different options and fees to consider. Understanding these differences can guide better decisions.

A good plan can make retirement years easier and safer. Take time to compare and pick wisely. Your future self will thank you for careful planning. Retirement security starts with smart choices today.