Military Service Financial Differentiator Retirement Planning: Maximize Benefits Now

Are you serving or have served in the military and wondering how your unique benefits affect your retirement? Your military service is more than just a job—it’s a powerful financial differentiator that can shape your retirement planning in ways many overlook.

Understanding how to use these special advantages can secure your future and give you peace of mind. Keep reading to discover how your military experience can become the key to a stronger, smarter retirement plan designed just for you.

Military Retirement Benefits

Pension Plans Explained

The military pension pays monthly income after retirement. It is based on years of service and rank. Most service members qualify after 20 years of duty. The pension amount grows with more years served. It offers steady, guaranteed income for life. This plan helps cover basic living costs after service ends.Thrift Savings Plan (tsp)

TSP is a retirement savings plan like a 401(k). Service members can contribute a part of their pay. The government may also add matching funds. Funds in TSP grow tax-deferred until withdrawal. It offers several investment choices to fit risk levels. TSP is a flexible way to save extra money for retirement.Disability Retirement Options

Disability retirement supports those unable to continue service due to injury. Benefits vary based on disability rating and years served. Payments replace lost income and help with medical costs. Some may receive both disability and pension payments. This option ensures financial help when health limits work ability. It is a vital benefit for injured service members.

Credit: www.synchrony.com

Maximizing Survivor Benefits

Maximizing survivor benefits is a key part of retirement planning for military families. These benefits provide financial security to your loved ones after your service ends. Understanding how to choose the right coverage can make a big difference in their future well-being.

Choosing The Right Coverage

Selecting the right survivor benefit plan depends on your family’s needs. Look at the options available through the military and private insurers. Each plan offers different levels of protection and payout amounts. Consider who will receive the benefits and how much they might need. Your choice should match your family’s financial goals and lifestyle.

Cost Vs. Benefit Analysis

Compare the cost of premiums to the benefits offered. Higher coverage often means higher premiums, but it also means more support for survivors. Calculate how much you can afford to pay regularly without straining your budget. Think about the long-term value of the benefits against the cost. Balancing cost and coverage helps you protect your family effectively without overspending.

Leveraging Military Discounts

Military service offers unique financial advantages. These benefits can help build a strong retirement plan. One key advantage is military discounts. These discounts reduce costs on many services and products. Using them wisely can save money over time. This section explores how to leverage these discounts for retirement planning.

Financial Services Offers

Banks and credit unions offer special deals to military members. Lower fees and better interest rates are common. Some offer free financial advice tailored to military life. These services help manage money and plan for retirement. Taking advantage of these offers can improve savings and reduce debt.

Housing And Education Savings

Military discounts also apply to housing and education. Some lenders provide lower mortgage rates for service members. This makes buying a home more affordable. Education programs often have reduced tuition or special grants. These savings lessen financial burdens and support long-term goals.

Credit: mygova.com

Tax Advantages For Veterans

Military veterans have special tax benefits that can help with retirement planning. These advantages reduce the money paid in taxes. They make retirement income stretch further. Understanding these benefits is key to better financial security.

Tax-free Retirement Income

Many military retirement payments are not taxed. This means veterans keep more of their money. Some states do not tax military pensions at all. This tax break helps veterans enjoy a steady income in retirement. Disability payments from the military are also usually tax-free. Veterans with disabilities can benefit from this rule. It offers extra financial relief during retirement years.

Deductions And Credits

Veterans may qualify for special tax deductions. These reduce taxable income, lowering the tax bill. Some states offer extra credits for military service. Credits directly reduce the amount of tax owed. Education benefits and home loan interest may also be deductible. These deductions can save thousands of dollars yearly. Veterans should check their eligibility to maximize savings.

Transitioning To Civilian Retirement

Transitioning from military service to civilian retirement can feel like stepping into a new world. Many veterans face unique financial challenges and opportunities during this change. Planning carefully helps secure a stable future. Understanding both military and civilian retirement options is key. This phase requires thoughtful decisions and good advice.

Integrating Military And Civilian Benefits

Military retirees often receive pensions and healthcare benefits. Civilian retirement plans add another layer of security. Combining these benefits needs careful planning. Know the rules of each benefit system. Coordinate your military pension with Social Security and civilian savings. This balance helps avoid gaps in income. Also, consider healthcare costs beyond military coverage. Proper integration maximizes your total retirement income.

Building A Diverse Portfolio

Diversity reduces risk in retirement savings. Veterans should include stocks, bonds, and other investments. Savings in different areas protect against market changes. Use a mix of short-term and long-term assets. Consider low-cost index funds for steady growth. Keep some money accessible for emergencies. Regularly review and adjust your portfolio. This approach helps keep your retirement plan strong and flexible.

Healthcare Planning For Retirees

Healthcare planning is a key part of retirement for military service members. It helps protect your health and manage medical costs. Planning early gives peace of mind and better care options. Retirees face unique healthcare needs that require special attention. Understanding available programs and long-term care options is essential. This guide explains important elements to consider for a secure healthcare future. It focuses on TRICARE and long-term care needs for military retirees.

Tricare Options

TRICARE offers health coverage for military retirees and their families. Several plans fit different needs and budgets. TRICARE Prime is a low-cost option with a primary care manager. TRICARE Select lets you choose any provider without referrals. Retirees should check eligibility and costs for each plan. Prescription drug coverage comes with most TRICARE options. Dental and vision plans are separate and may require extra fees. Understanding these details helps you pick the right coverage.

Long-term Care Considerations

Long-term care covers help for daily living activities. It includes help with bathing, dressing, and meals. Military retirees need to plan for possible long-term care needs. VA offers some long-term care benefits for eligible veterans. Private insurance and Medicaid are other options to explore. Planning early reduces stress and financial burden later. Consider your health risks and family support when planning.

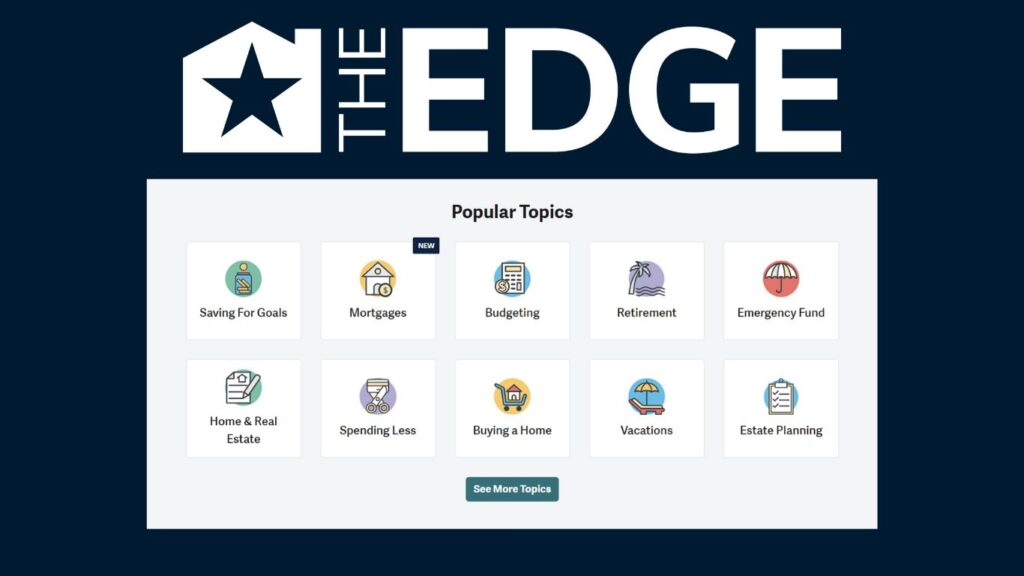

Financial Tools For Military Families

Military families face unique financial challenges and opportunities. Using the right financial tools helps them plan better for retirement. These tools support steady savings and smart spending. They make future goals clearer and easier to reach.

Budgeting And Debt Management

Creating a budget is the first step to control finances. It tracks income and expenses clearly. Military pay can vary, so budgeting helps adjust spending quickly. Paying off debt reduces stress and frees up money. Prioritize high-interest debts to save on extra costs. Use simple apps or spreadsheets to stay organized. Regular reviews keep the budget realistic and effective.

Investment Strategies

Investing builds wealth over time for retirement. Military families should focus on low-risk options due to service uncertainty. Consider military-specific plans like the Thrift Savings Plan (TSP). Diversify investments to reduce risk and protect money. Start early to benefit from compound growth. Keep investment goals aligned with retirement needs. Seek advice from trusted financial counselors familiar with military benefits.

Credit: www.covenanthealth.com

Frequently Asked Questions

What Makes Military Retirement Planning Different From Civilian?

Military retirement often includes pensions, healthcare, and benefits not typical in civilian plans.

How Does Military Service Impact Retirement Savings?

Military pay and benefits can boost retirement savings through special programs and tax advantages.

Can Veterans Use Military Benefits For Retirement Income?

Yes, veterans may access pensions, disability pay, and healthcare as part of retirement income.

What Financial Challenges Do Military Retirees Face?

Adjusting to civilian life, managing healthcare costs, and planning for long-term income are common challenges.

How To Start Retirement Planning During Military Service?

Begin by learning about military benefits, saving early, and consulting financial advisors familiar with military needs.

Conclusion

Military service offers unique financial benefits for retirement planning. These benefits can provide steady income and support after service ends. Planning early helps you use these benefits wisely. Consider pensions, healthcare, and savings options available to you. Understanding your military financial advantages leads to better security.

Take time to review your options and make smart choices. Your retirement can be more stable with the right planning. Military service financial benefits are valuable tools for your future. Use them well to build a strong retirement plan.