Profit Executive Retirement Plans: Maximize Wealth & Secure Future

Are you looking for a smart way to secure your future while maximizing your business’s benefits? Profit executive retirement plans could be the key you’ve been searching for.

These plans are designed to help you, as a business owner or executive, save more for retirement with tax advantages that ordinary plans might not offer. Imagine having a strategy that not only boosts your savings but also rewards your top executives.

Keep reading to discover how profit executive retirement plans work and why they might be the perfect fit for your financial goals.

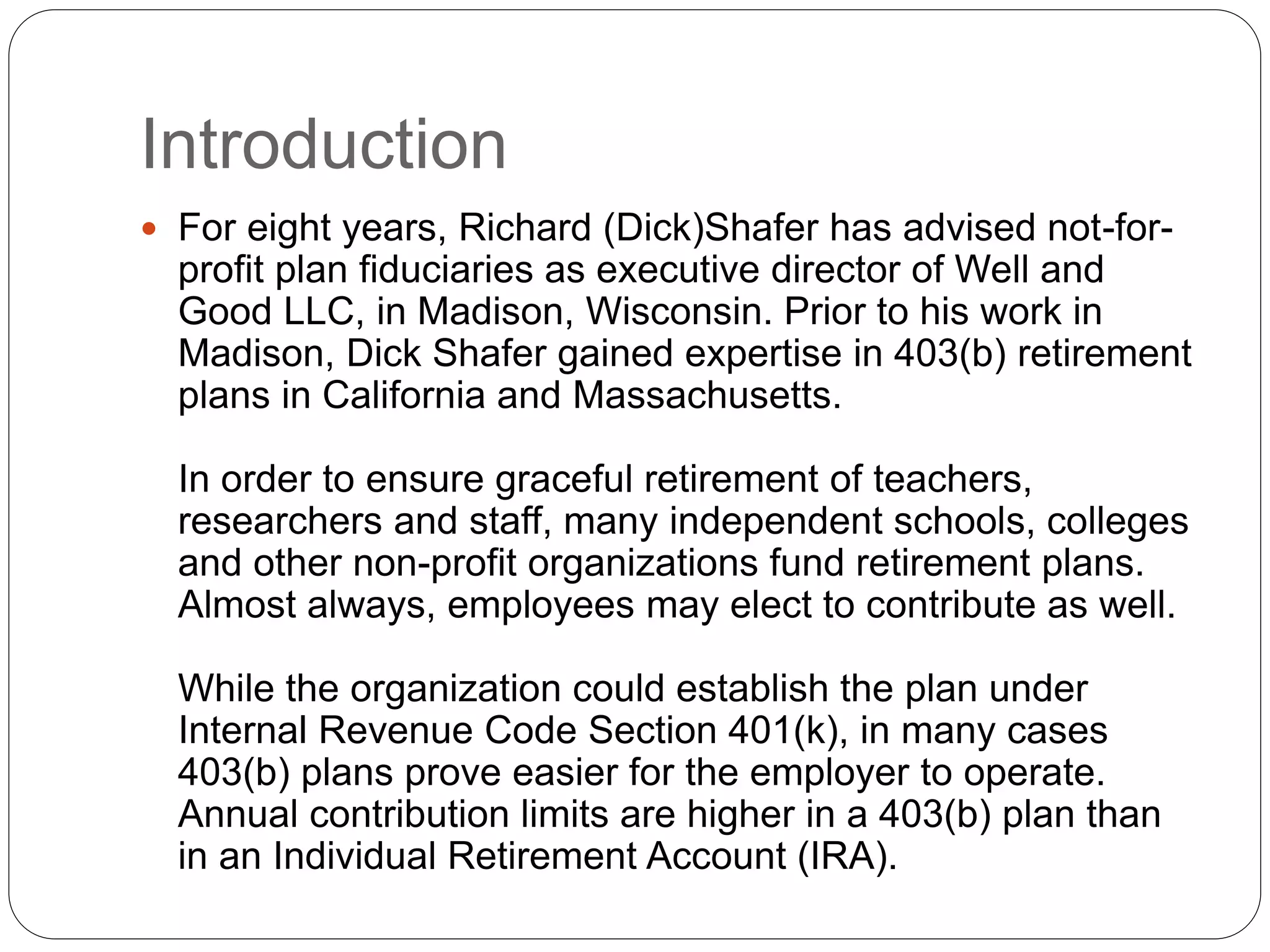

Credit: secure.acce.org

Profit Executive Retirement Plans

Choosing The Right Plan: Choosing the right Profit Executive Retirement Plan matters a lot for your future. This choice affects how much you save and how comfortable your retirement will be. Picking a plan that fits your business size and goals makes saving easier and more effective. Several types of Profit Executive Retirement Plans exist. Each has unique rules and benefits. Understanding these helps you select the best option.

Understanding Different Plan Types

Profit Executive Retirement Plans include 401(k)s, profit-sharing plans, and defined benefit plans. Each type offers distinct advantages. For example, 401(k) plans allow personal contributions. Profit-sharing plans let employers add money based on profits. Defined benefit plans promise a fixed payout at retirement.

Evaluating Your Business Needs

Consider your company size, cash flow, and goals. Small businesses may prefer simple plans with low costs. Larger companies might want plans with higher contribution limits. Think about how much you want to save annually. Also, check if you want to include key employees in the plan.

Considering Contribution Limits And Tax Benefits

Each plan has different contribution limits. Higher limits help save more money for retirement. Most plans offer tax advantages. Contributions may reduce taxable income. Earnings grow tax-deferred until withdrawal. This helps your savings grow faster.

Reviewing Administrative Requirements

Some plans need more paperwork and management. Simple plans require less time and fewer reports. Complex plans need annual filings and compliance checks. Choose a plan that fits your capacity to manage it well.

Consulting With A Retirement Plan Expert

Experts guide you through plan options and rules. They help tailor a plan to your business. Professional advice ensures you avoid costly mistakes. It saves time and increases confidence in your choice.

Tax Benefits Explained

Tax-deferred Growth

Profit Executive Retirement Plans let your money grow without immediate tax. Earnings like interest and dividends are not taxed each year. Taxes are paid only when you withdraw funds. This delay helps your savings compound faster over time.Tax-deductible Contributions

Contributions to these plans may reduce your taxable income. This lowers the amount of income tax you owe each year. You save money now and build your retirement fund at the same time. Check the specific rules to see how much you can contribute.Flexible Withdrawal Options

Withdrawals from Profit Executive Retirement Plans have tax advantages too. You can choose when to take money out. Planning withdrawals can help minimize your tax bill. Some withdrawals might be taxed at a lower rate based on your income.Contribution Limits

Contribution limits define how much money you can put into a Profit Executive Retirement Plan each year. These limits help you save enough for retirement without exceeding legal rules. Understanding these limits is important to maximize your benefits and avoid penalties.

Annual Contribution Cap

The annual contribution cap sets the highest amount you can add yearly. This limit includes both employer and employee contributions. Staying under this cap ensures your plan stays compliant with tax laws.

Catch-up Contributions

Catch-up contributions let those over 50 save extra money. This rule helps older workers boost their retirement savings. It is a valuable option for those who want to increase contributions later in their careers.

Employer Vs. Employee Contributions

Employer and employee contributions have different rules and limits. Employers often match a portion of employee contributions. Knowing these differences helps you plan your savings wisely.

Impact Of Compensation On Limits

Your income affects how much you can contribute. Higher earnings may allow larger contributions. The plan uses your compensation to calculate your maximum limit.

Annual Adjustments

Contribution limits can change each year. These adjustments reflect inflation and IRS updates. Staying informed helps you take full advantage of your retirement plan.

Investment Options

Profit Executive Retirement Plans offer various investment options. These choices help you build a strong retirement fund. Each option has different risks and rewards. You can select based on your comfort and goals.

Stocks

Stocks represent ownership in a company. They offer high growth potential over time. Stocks can be risky but often yield good returns. Ideal for investors who accept market ups and downs.

Bonds

Bonds are loans to governments or companies. They pay fixed interest over a period. Bonds are safer than stocks but offer lower returns. Suitable for conservative investors seeking steady income.

Mutual Funds

Mutual funds pool money from many investors. They invest in stocks, bonds, or both. This option spreads risk across many assets. Good for beginners and those wanting diversity.

Real Estate

Real estate investments include property or real estate funds. They provide rental income and potential value growth. Real estate adds variety to your portfolio. It requires more management and upfront money.

Cash And Equivalents

Cash options include savings accounts or money market funds. These investments are very safe and liquid. Returns are low but funds are easy to access. Useful for short-term needs or emergencies.

Risk Management Strategies

Risk management is a key part of Profit Executive Retirement Plans. It helps protect your savings from unexpected problems. Good strategies lower risks and keep your retirement secure. Understanding these strategies can help you feel more confident about your future.

Understanding Investment Risks

Investments can rise or fall in value. Knowing the risks helps you choose safer options. Diversifying your investments spreads risk across different areas. This way, one loss does not hurt your whole plan.

Setting Clear Retirement Goals

Clear goals guide your risk choices. Decide how much money you need and when. This helps in selecting investments that match your time frame and risk comfort.

Regular Plan Reviews

Check your retirement plan often. Markets and personal situations change over time. Adjust your plan to keep it on track and reduce risks.

Using Insurance Options

Insurance can protect your retirement savings. It covers unexpected events like health issues or market drops. Including insurance in your plan adds an extra safety layer.

Withdrawal Rules

Understanding the withdrawal rules for Profit Executive Retirement Plans is vital. These rules explain how and when you can take money from your plan. They also detail any penalties or taxes that might apply. Knowing these rules helps you plan your retirement income well.

Age Requirements For Withdrawals

You can start withdrawing money without penalties at age 59½. Taking money before this age may cause penalties and taxes. Some exceptions allow early withdrawals without penalties. Always check the specific rules for your plan.

Required Minimum Distributions (rmds)

RMDs are the minimum amounts you must withdraw each year. They usually start at age 73. The government sets these rules to ensure you use your savings. Missing RMDs can result in heavy penalties.

Tax Implications On Withdrawals

Most withdrawals count as taxable income. Taxes depend on your tax bracket at withdrawal time. Some plans offer tax-free withdrawals for certain types of income. Knowing tax rules helps avoid surprises during tax season.

Withdrawal Process And Paperwork

To take money out, you must fill out withdrawal forms. Some plans allow online withdrawal requests. Processing times vary by provider. Keep copies of all documents for your records.

Maximizing Employer Benefits

Maximizing employer benefits in Profit Executive Retirement Plans helps businesses save money and support their employees. These plans offer tax advantages and flexible contribution options. Employers can improve their financial health and attract skilled workers by using these benefits well.

Tax Savings For Employers

Employers can reduce their taxable income through plan contributions. These contributions are usually tax-deductible. This lowers the overall tax bill for the business. Saving on taxes frees up funds for other company needs.

Flexible Contribution Limits

Profit Executive Retirement Plans allow varying contribution amounts. Employers can adjust contributions based on business performance. This flexibility helps manage cash flow effectively. It also allows increasing benefits in profitable years.

Attracting And Retaining Talent

Offering strong retirement plans appeals to skilled workers. Employees value financial security for their future. Good benefits improve job satisfaction and loyalty. This reduces turnover and hiring costs for employers.

Control Over Plan Design

Employers can customize plan features to fit their goals. Choices include vesting schedules and eligibility rules. Custom plans meet specific business and employee needs. Control helps create a fair and motivating benefit program.

Credit: definiti.com

Credit: www.slideshare.net

Frequently Asked Questions

What Is A Profit Executive Retirement Plan?

A Profit Executive Retirement Plan is a special savings plan for business leaders to grow retirement funds.

How Does A Profit Executive Retirement Plan Work?

It lets executives save more money for retirement with tax benefits and employer contributions.

Who Benefits Most From Profit Executive Retirement Plans?

High-income executives and business owners gain the most from these plans due to higher contribution limits.

Can Profit Executive Retirement Plans Reduce Taxable Income?

Yes, contributions to these plans often lower taxable income, helping save money on taxes each year.

Conclusion

Profit executive retirement plans offer solid ways to save for the future. They help business owners and key employees build retirement funds. These plans come with tax benefits and flexible options. Choosing the right plan depends on your business size and goals.

Start early to take full advantage of the benefits. Regular reviews keep your plan on track for success. Secure your retirement with smart planning today. A good plan supports both you and your business long-term.