Retirement Cash Flow Planning: Maximize Income for Lifelong Security

Planning your retirement cash flow is one of the smartest moves you can make right now. Imagine having a steady stream of income that covers all your needs without worry.

You might wonder how to make your savings last, or how to avoid running out of money too soon. This guide will help you understand how to manage your income and expenses so you can enjoy your retirement with confidence.

Keep reading to discover simple strategies that put you in control of your financial future.

Credit: invisionfc.com

Setting Retirement Income Goals

Setting retirement income goals is a key step in planning your financial future. Clear goals help you know how much money you need each month. This makes it easier to create a budget and save the right amount. Without goals, you might spend too much or too little. Think about your lifestyle in retirement. What will you spend money on? Housing, food, health care, and hobbies are common expenses. Some costs might go down, like work clothes or commuting. Others may increase, such as medical bills or travel. Setting income goals also means planning for unexpected costs. Emergencies can happen, and having a cushion is wise. Decide how much you want for daily expenses and extra funds for surprises.

Estimate Monthly Expenses

Start by listing your current monthly costs. Then adjust for retirement changes. For example, you may pay off your mortgage, but spend more on health care. Include all essentials and extras. This gives a clear picture of needed income.

Consider Income Sources

Know where your retirement money will come from. Social Security, pensions, savings, and investments all add up. Check how much each source pays monthly. This helps find gaps between income and expenses.

Set Realistic Income Targets

Use your expense estimate and income sources to set goals. Be honest about what you need and can get. Aim for a balance that covers your needs without stress. Adjust goals over time as your situation changes.

Credit: www.sensiblemoney.com

Estimating Retirement Expenses

Estimating retirement expenses is a key step in planning your cash flow after leaving work. Knowing your costs helps you prepare a budget that lasts through retirement. It also guides how much money you need to save beforehand. Many people overlook some expenses or guess too low. This can cause money problems later. Careful planning reduces stress and keeps your finances steady.

Basic Living Costs

Start with essentials like housing, food, and utilities. These costs usually continue or change little after retirement. Think about rent or mortgage, electricity, water, and groceries. Include phone and internet bills too.

Healthcare And Insurance

Health costs often rise with age. Plan for doctor visits, medications, and treatments. Add insurance premiums and out-of-pocket expenses. Don’t forget dental and vision care.

Leisure And Travel

Many retirees enjoy hobbies and trips. Budget for vacations, hobbies, and dining out. These costs vary but affect your overall spending. Include them to keep your lifestyle enjoyable.

Unexpected Expenses

Set aside money for emergencies and repairs. This can cover home fixes, car repairs, or sudden health costs. Having a buffer prevents financial surprises.

Sources Of Retirement Income

Social Security Benefits

Social Security provides a steady monthly payment. It is based on your work history and earnings. You can start receiving benefits as early as age 62. Waiting longer increases your monthly payment. This income helps cover basic living costs.Pension Plans

Pension plans offer regular income after retirement. They are often provided by employers. The amount depends on your salary and years of service. Pensions give a predictable and stable income stream. Not all jobs offer pensions today.Personal Savings And Investments

Personal savings include money set aside in bank accounts. Investments may include stocks, bonds, or mutual funds. These funds can grow over time. You can withdraw from them to cover expenses. Managing these wisely adds flexibility to your income.Creating A Sustainable Withdrawal Strategy

Creating a sustainable withdrawal strategy is key for steady income in retirement. It helps protect savings from running out too soon. A good plan balances spending needs and investment growth. Careful planning reduces stress about money during retirement. It allows you to enjoy life without constant worry. The goal is to withdraw funds in a way that lasts for decades.

Understanding Safe Withdrawal Rates

Safe withdrawal rates guide how much money you can take yearly. Many experts suggest withdrawing around 4% of your savings each year. This rate aims to keep your money lasting 30 years or more. Adjust withdrawal rates based on market performance and personal needs. Lower rates may be needed during market downturns. Higher rates might work if your investments do well.

Balancing Income Sources

Combine different income sources to create steady cash flow. Social Security, pensions, and savings all play a role. Diversifying income helps protect against unexpected changes. Plan withdrawals to avoid dipping too much into one source. This spreads risk and keeps funds stable for longer periods.

Adjusting Withdrawals For Inflation

Inflation reduces money’s buying power over time. Increase withdrawals slightly each year to keep up with rising costs. This protects your lifestyle and covers basic expenses. Be cautious not to raise withdrawals too fast. Too much increase can drain savings early.

Monitoring And Revising Your Plan

Review your withdrawal strategy regularly. Life changes and market shifts affect your plan’s success. Update your plan to stay on track with your goals. Small adjustments can prevent running out of money. Stay flexible and respond to new financial information.

Managing Inflation And Market Risks

Managing inflation and market risks is vital in retirement cash flow planning. Inflation reduces the buying power of your money over time. Market risks can cause the value of investments to change suddenly and unpredictably. Both factors can affect your retirement income and lifestyle. Planning carefully can help protect your savings. It ensures your money lasts longer. It also helps keep your spending steady despite economic changes.

Inflation’s Impact On Retirement Savings

Inflation means prices rise gradually. Things you buy today will cost more later. If your income stays the same, you can buy less over time. Retirement savings must grow enough to beat inflation. Otherwise, your funds may lose value.

Strategies To Combat Inflation

Invest in assets that tend to rise with inflation. Examples include certain stocks and real estate. Consider Treasury Inflation-Protected Securities (TIPS). These adjust with inflation rates. Keep some money in accounts that offer interest above inflation.

Understanding Market Risks

Market risks include changes in stock prices, interest rates, and economic conditions. These can lower the value of your investments. Retirees need to reduce exposure to risky assets. This helps avoid sudden losses that hurt income.

Balancing Risk And Income Needs

Create a mix of investments. Use safer options like bonds and cash for steady income. Keep some growth assets to protect against inflation. Review your portfolio regularly. Adjust it as your needs and market conditions change.

Incorporating Annuities For Steady Income

What Are Annuities?

Annuities are contracts with insurance companies. You pay a lump sum or series of payments. In return, the insurer pays you income regularly. Payments can start immediately or after some time.Types Of Annuities

Fixed annuities offer guaranteed payments. The amount stays the same throughout the contract. Variable annuities depend on investment performance. Payments may rise or fall. Indexed annuities link returns to market indexes but protect the principal.Benefits Of Annuities For Retirement

Annuities provide predictable income, reducing money worries. They protect against outliving savings. Some annuities offer tax advantages. They help balance other retirement income sources for stability.Risks And Considerations

Annuities may have fees and surrender charges. Inflation can reduce purchasing power over time. Not all annuities suit every retiree. It is important to review terms carefully before buying.How To Include Annuities In Your Plan

Start by assessing your income needs. Decide how much money to allocate. Combine annuities with other income sources. Regularly review your plan to adjust if needed.Tax-efficient Retirement Income Planning

Understanding Tax Brackets In Retirement

Know how tax brackets affect your retirement income. Different income levels are taxed at different rates. Withdraw only what keeps you in a lower tax bracket. This simple step saves money every year.Using Tax-advantaged Accounts Wisely

Use accounts like Roth IRAs and traditional IRAs strategically. Roth accounts allow tax-free withdrawals after retirement. Traditional accounts provide tax breaks now but tax income later. Mixing these accounts helps manage taxes better.Timing Your Withdrawals

Timing matters for taking money out. Withdraw too much early and face higher taxes. Spread withdrawals to avoid jumping into a higher tax bracket. Plan withdrawals to match your spending needs and tax goals.Considering Social Security Benefits

Social Security benefits may be taxable. The tax depends on your total income. Keep income low to reduce Social Security taxes. Delay benefits if possible to increase monthly payments and reduce taxes.Minimizing Required Minimum Distributions (rmds)

RMDs force you to take money from certain accounts after age 73. These withdrawals count as taxable income. Plan to reduce RMDs by converting to Roth IRAs early. This lowers taxable income in later years.Adjusting Plans For Changing Needs

Retirement cash flow planning is not a one-time task. Life changes, expenses shift, and so do your financial needs. Adapting your plan helps keep your finances stable. It makes sure your money lasts through all stages of retirement. Planning adjustments protect your lifestyle. They help you handle unexpected costs. Being flexible reduces stress and improves confidence in your financial future.

Monitoring Your Spending Patterns

Track your monthly expenses regularly. Notice where you spend more or less. Some costs go down, like work-related expenses. Others, like health care, may rise. Adjust your budget to reflect these changes. This keeps your cash flow balanced and realistic.

Reassessing Income Sources

Review your income streams often. Social Security, pensions, and investments may change. Interest rates and market returns fluctuate. Consider new income opportunities if needed. Knowing your income clearly helps avoid surprises.

Planning For Unexpected Expenses

Set aside emergency funds. Health issues or home repairs can happen anytime. Having savings ready avoids debt and stress. Update this fund based on your current needs. Preparedness means smoother handling of sudden costs.

Adjusting Withdrawal Rates

Change how much you withdraw from savings. Lower withdrawals if your investments perform poorly. Increase withdrawals carefully when needed. This protects your savings from running out too soon. Keep withdrawal rates flexible to fit your situation.

Consulting Financial Advisors Regularly

Meet with financial experts often. They provide fresh insights and advice. They help you spot risks and opportunities. Professional guidance keeps your plan on track. Regular check-ins build a stronger retirement strategy.

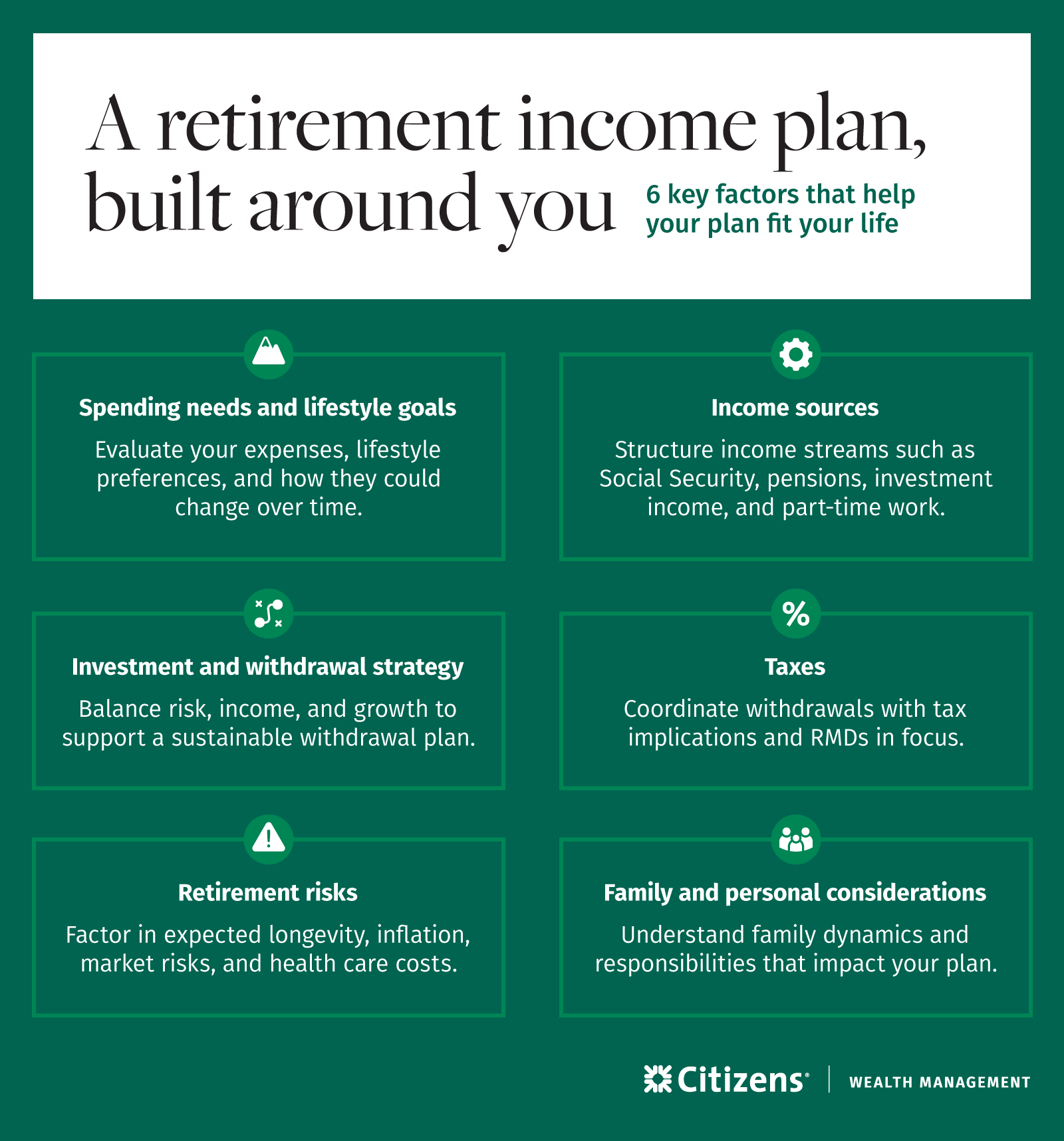

Credit: www.citizensbank.com

Frequently Asked Questions

What Is Retirement Cash Flow Planning?

Retirement cash flow planning means managing your money to cover expenses during retirement.

How Do I Calculate My Retirement Cash Flow Needs?

Add your expected monthly expenses and subtract any guaranteed income like pensions.

Why Is Cash Flow Important In Retirement?

It ensures you have enough money to pay bills and enjoy life without stress.

What Are Common Sources Of Retirement Cash Flow?

Savings, Social Security, pensions, and investment income are typical cash flow sources.

How Can I Avoid Running Out Of Money In Retirement?

Plan carefully, track spending, and adjust withdrawals to match your income and needs.

Conclusion

Planning your retirement cash flow helps you live comfortably later. It keeps your money steady and meets daily needs. Tracking income and expenses avoids surprises and stress. Start early and adjust as life changes. A clear plan gives peace of mind and control.

Retirement should be a time to enjoy, not worry. Take small steps now for a secure future. Your efforts today build a stable tomorrow. Simple actions make a big difference in your retirement life.